2. Creation of Savings Account

Oracle FLEXCUBE facilitates account opening from different sources. This chapter discusses and takes you through the available options, stages involved and account opening workflow. In the first section, the chapter briefs you on the process involved. The next section talks about the steps involved in detail.

This chapter contains the following topics:

- Section 2.1, "Account Creation Process"

- Section 2.2, "Lead Requests"

- Section 2.3, "Processing Requests through STP"

- Section 2.4, "Channel Workflow Chart"

- Section 2.5, "Stages for Request Received through Branch (BPEL)"

- Section 2.6, "Receive and Verify"

- Section 2.7, "Seek Approval for Missing Documents / Details"

- Section 2.8, "Modifying and Resubmit the Application"

- Section 2.9, "Input Details of Savings Account"

- Section 2.10, "Verify Details of Savings Account"

- Section 2.11, "Modify Details of Savings Account"

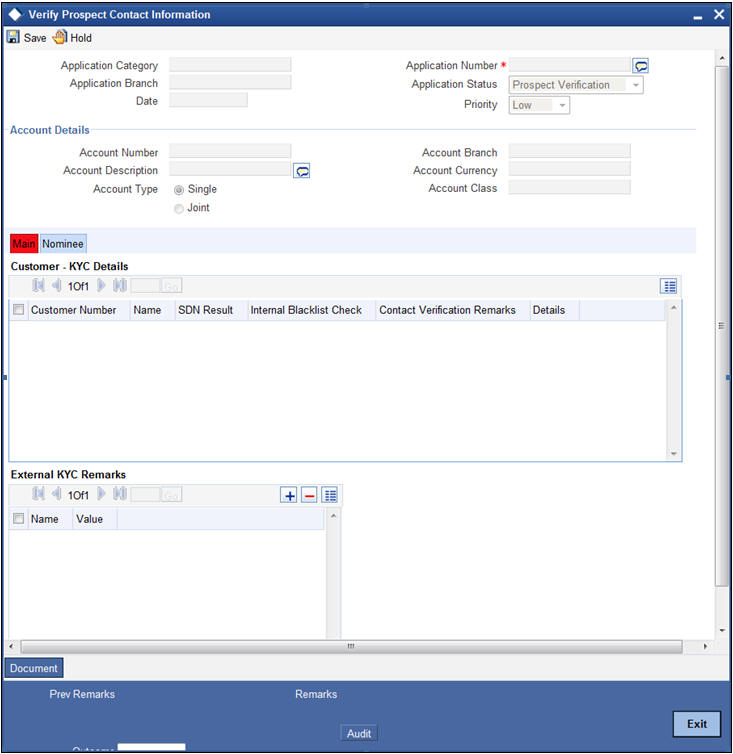

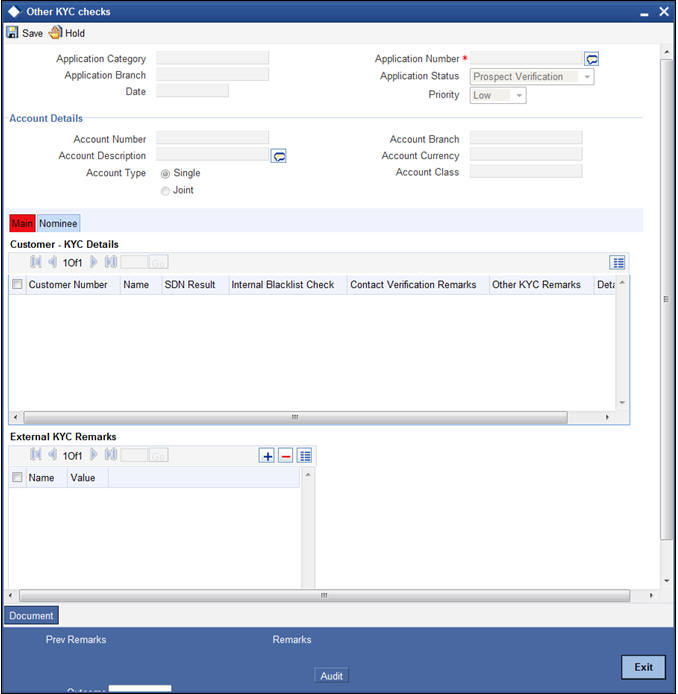

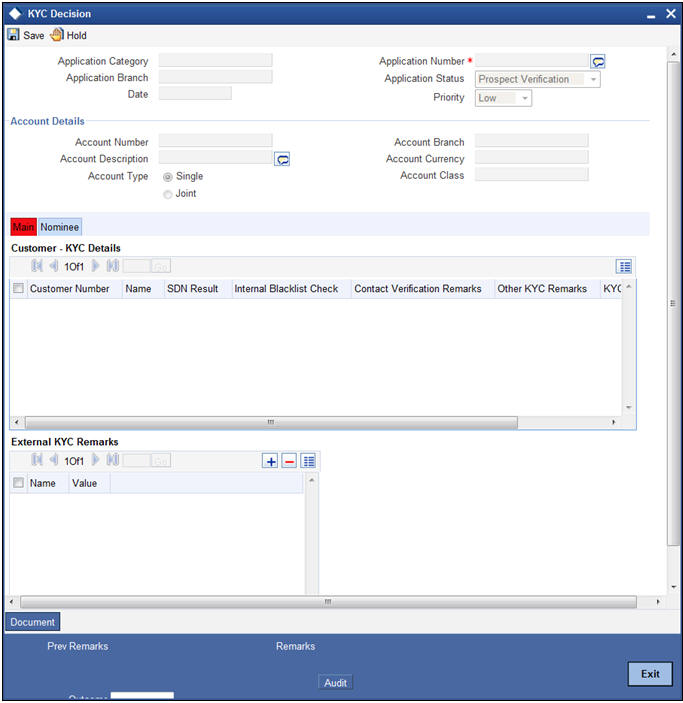

- Section 2.12, "KYC_R Review Info "

- Section 2.13, "Block Customer in the System"

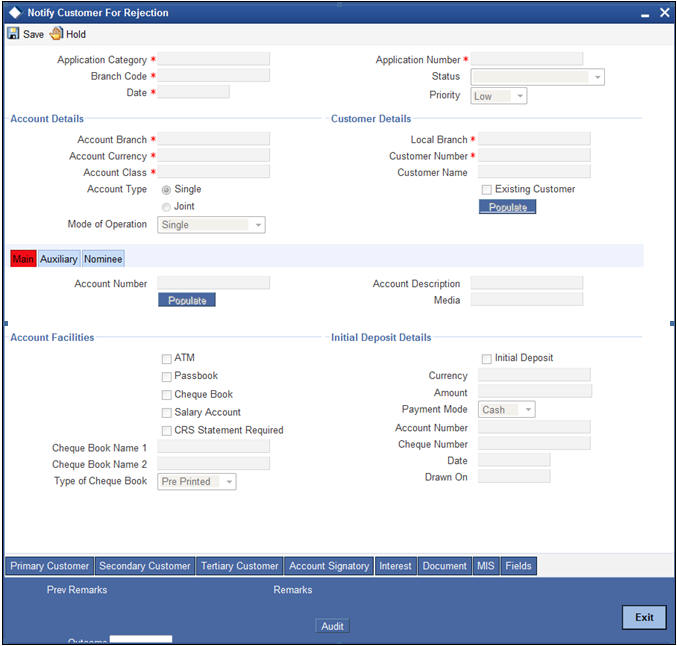

- Section 2.14, "Notify Customer on Negative Status of KYC Checks"

- Section 2.15, "Modify Penny Credit Details"

- Section 2.16, "Validate Penny Credit Details"

- Section 2.17, "Create / Modify Customer Details in Oracle FLEXCUBE"

- Section 2.18, "Create Account"

- Section 2.19, "Store document reference in Oracle FLEXCUBE"

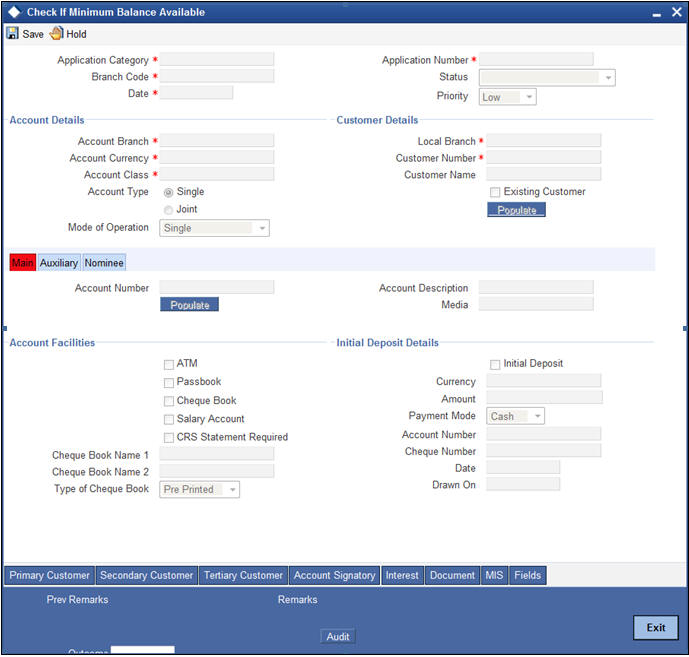

- Section 2.20, "Check Available Balance"

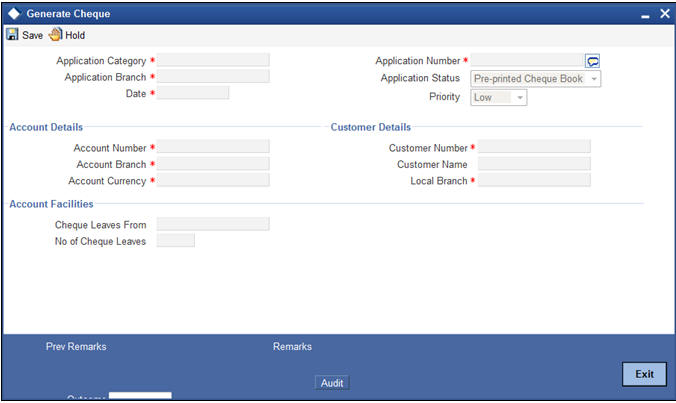

- Section 2.21, "Generate Cheque Book "

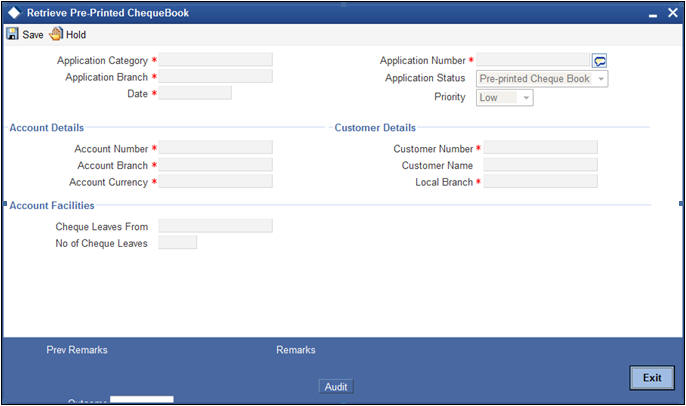

- Section 2.22, "Retrieve Pre-printed Cheque Book "

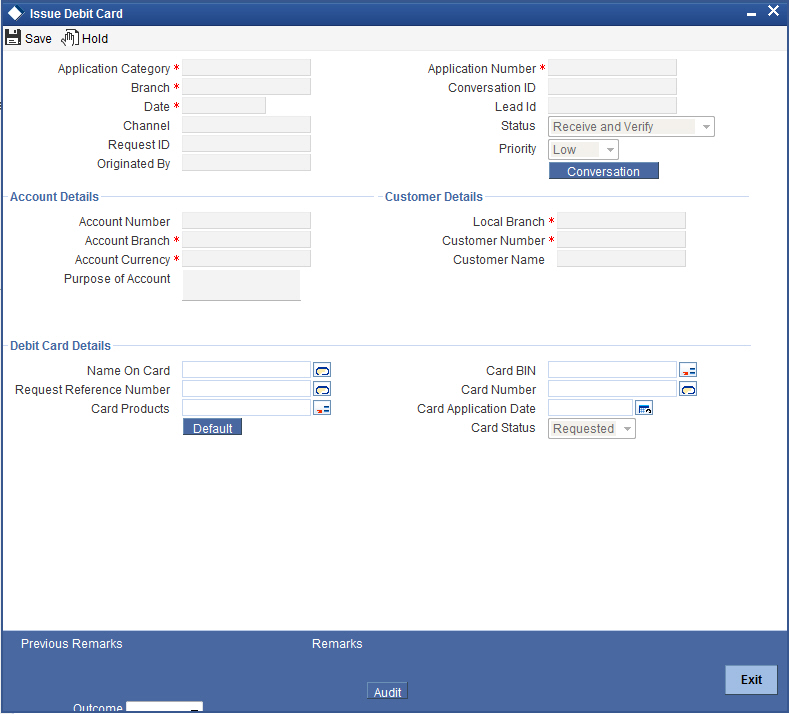

- Section 2.23, "Issue Debit Card"

- Section 2.24, "Generate Welcome / Thank You Letter"

- Section 2.25, "Notify the customer/prospect about the successful account opening with details"

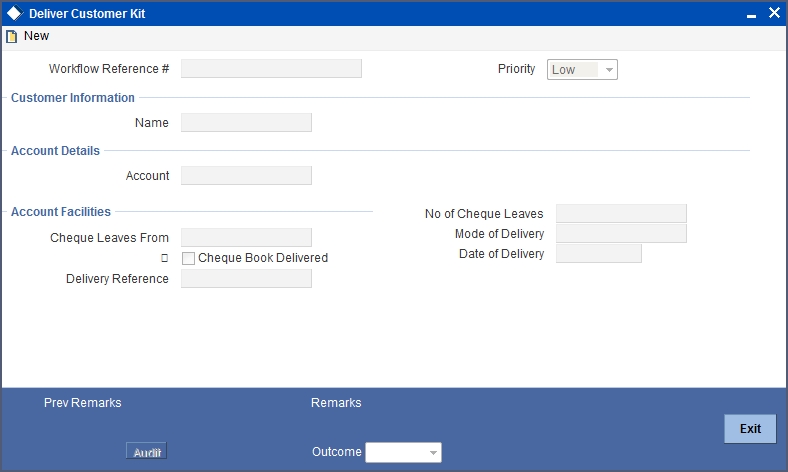

- Section 2.26, "Deliver Account Kit to the Customer"

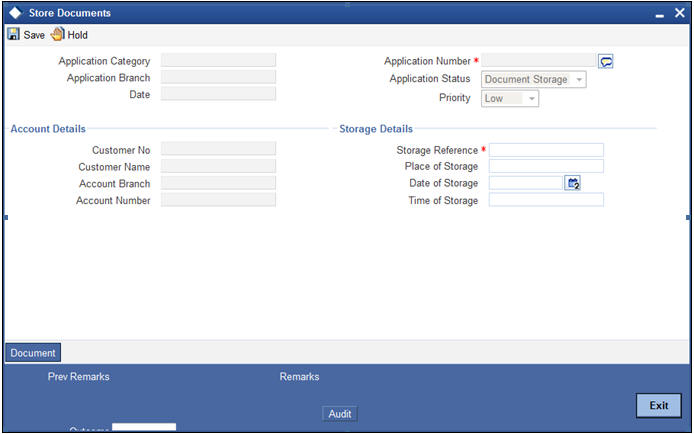

- Section 2.27, "Store Documents"

2.1 Account Creation Process

The process of creating a savings account begins with a bank receiving an account opening application and the related documents from a customer. A bank can receive this application either from a:

- Prospect – On receiving the request, customer is created in ‘Customer Maintenance’ screen and customer account is created at ‘Customer Maintenance’ screen. After the successful creation of customer and account, the prospect is informed about it. If the KYC check is not passed, then the application is rejected.

- Existing Customer – While opening an account for an existing customer, the bank checks KYC details, only if there are any changes in the existing KYC information of the customer. If the KYC check is not passed the application is rejected after blocking the existing accounts.

For a customer who passes the KYC check, the customer ID is created/ updated and the customer account is opened in the relevant system and the kit is dispatched

Prospect/customer can contact bank either through

- Channel – A request to open an account can be through any of

the following routes.

- Lead Request

Account opening through BPEL

- Lead

Account opening through standard account opening process

- Account opening request through STP

- Account opening request through BPEL

- Lead Request

- Branch – A request to open an account is through BPEL

After receiving a request, the bank verifies whether the details/documents required to process the request are available. If any documents are missing, then the bank will either decide to proceed after obtaining the missing details/documents or to process the request without waiting for the missing details/documents; however, with necessary approvals.

The following sections provide details on the process followed for Lead Maintenance and BPEL workflow.

2.2 Lead Requests

This section contains the following topics:

- Section 2.2.1, "Processing Lead Requests"

- Section 2.2.2, "Main Tab"

- Section 2.2.3, "Details Tab"

- Section 2.2.4, "Financial Tab"

- Section 2.2.5, "Requested Tab"

- Section 2.2.6, "Document Details"

- Section 2.2.7, "Processing and Validating Fields in Lead Maintenance"

- Section 2.2.8, "Processing Lead Requests"

- Section 2.2.9, "Lead Workflow Chart"

2.2.1 Processing Lead Requests

Lead requests received from a prospective customers are handled at Lead Maintenance level and the facility is available to external channels as a service. As mentioned earlier, for a lead record, customer and account are created directly through Customer Information and Customer Account Creation screens respectively or through BPEL workflow.

Lead requests from an existing customer are also handled a Lead Maintenance level. However, for a lead record for an existing customer, the requested account is created directly through Customer Account Creation screen or BPEL workflow.

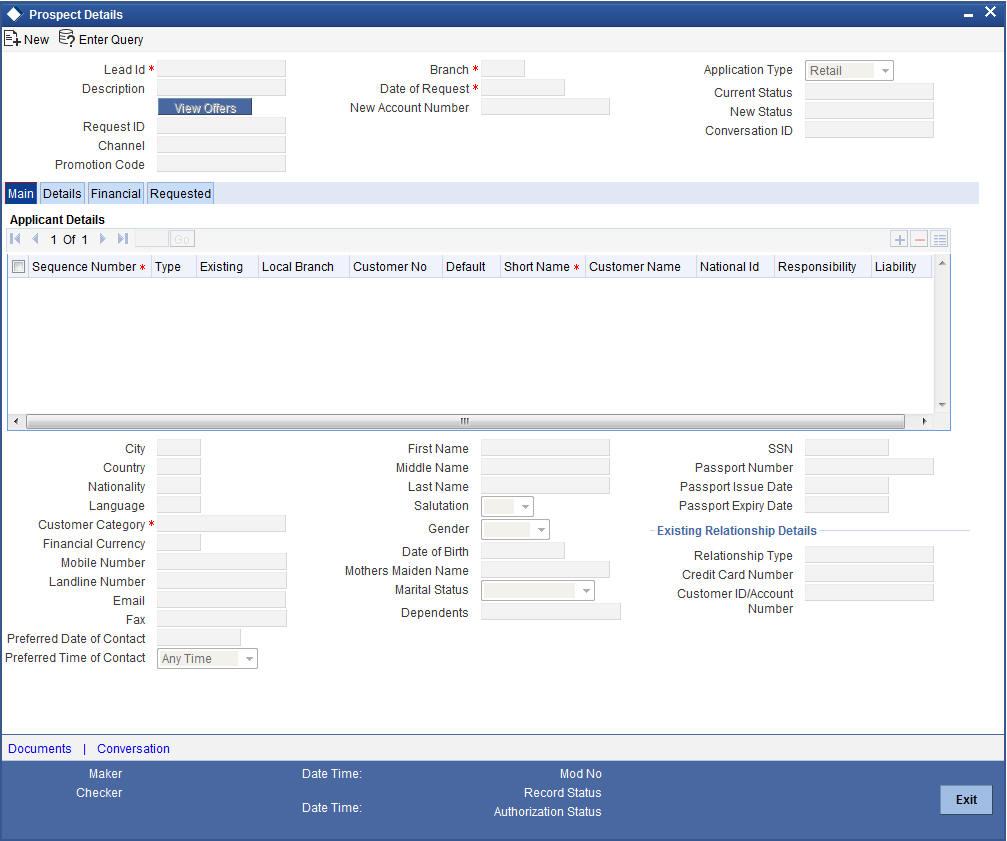

You can maintain the details of a prospective/existing applicant, when the applicant initially approaches the bank to open an account. The system facilitates capturing of lead details through external channels as well.

The following details are captured as part of this maintenance:

- Prospective/existing customer’s personal and location details

- Prospective/existing customer’s employment details

- Lead life cycle management

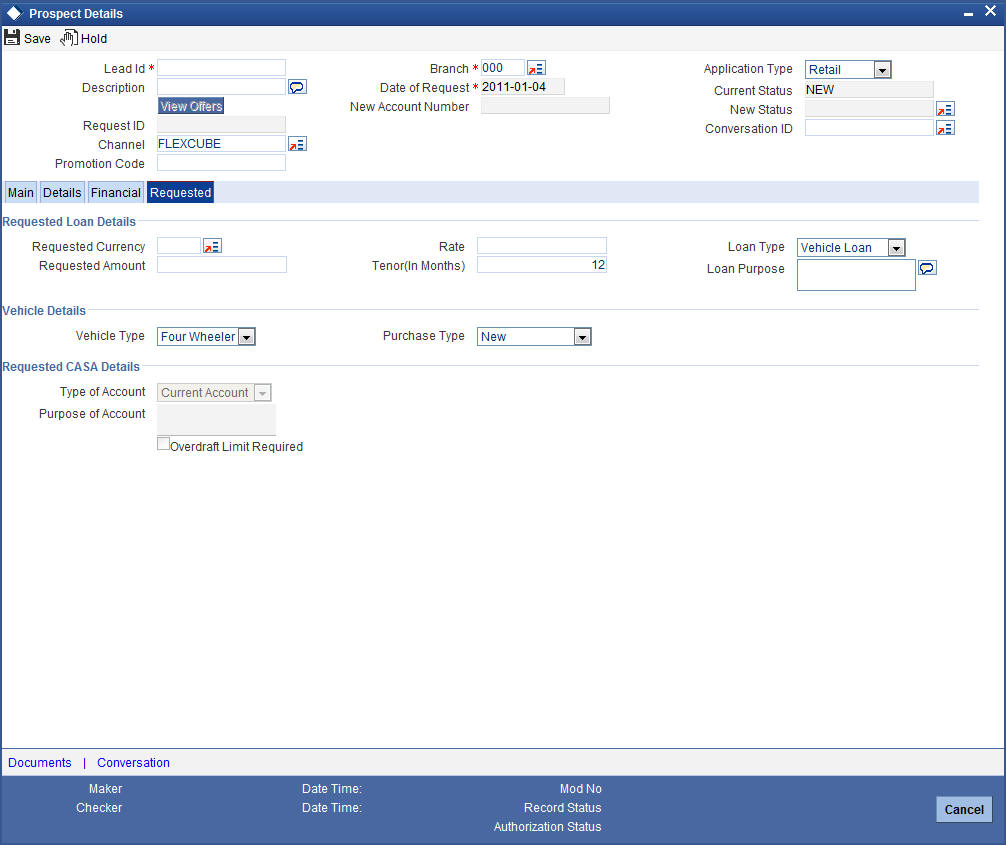

You can invoke this screen by typing ‘ORDLEADM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details in this screen:

Lead Id

Specify a unique identification for the prospective customer.

Description

Specify a suitable description for the prospective customer.

Request ID

The system displays the request identification of the request.

Channel

The system by default displays ‘FLEXCUBE’ as the channel. However, you can modify if needed. The adjoining option list displays a list of valid channels. Select the appropriate one.

Date of Request

Specify the date when the prospective customer enquired about the account. You can also select the date from the adjoining ‘Calendar’ icon.

Application Type

Select the application type as ‘CASA’ from the adjoining drop-down list.

Current Status

The system displays the current status of the lead.

New Status

Select the new status from the adjoining option list. It is mandatory to specify the reason if the current status is ‘Closed’, ‘Rejected’ or ‘Additional Document Required’.

After authorization, the new status becomes the current status of the lead.

Conversation ID

Specify the conversation ID, if conversation is originated before the lead record submission. The adjoining option list displays all valid conversation IDs. Select the appropriate one.

2.2.2 Main Tab

You can capture the following personal and geographical details related to a prospective customer:

Sequence Number

The system displays the sequence number.Type

Select the type of the customer from the drop-down list provided. The following options are available:

- Primary

- Co-Applicant

Existing

Check this box, if the lead applicant is an existing customer.

Local Branch

Select the local branch of an existing customer from the adjoining option list.

Customer No

Specify the customer, if the Customer is existing. The adjoining option list displays all valid customer numbers. Select the appropriate one. If the Customer is prospect, then the system generates the new customer ID, by default.

Default

Click on default button to default the details on existing customer.

Short Name

The system defaults the Short name when default button is pressed, if the applicant is an existing customer. However, you can specify the short name, if the applicant is prospect.

Customer Name

The system defaults the Customer name when default button is pressed, if the applicant is an existing customer. However, you can specify the customer name, if the applicant is prospect.

National ID

Specify the national Id or country code of the customer or select the national Id from the option list provided.

Responsibility

Select the responsibility from the adjoining drop down list.

Liability

Specify the liability for all parties other than primary applicant.

City

Specify the city of the customer.If the lead is received from the channel (FCDB), then the city value is passed by the FCDB to FCUBS and is defaulted here.

Country

Specify the country of domicile of the customer or select the country code from the option list provided.

Nationality

Specify the country of which the customer is a national or select the country code from the option list provided.

Language

Specify the primary language of the customer or select the language from the option list provided.

Customer Category

Specify the category to which the customer belongs or select the customer category from the option list that displays all valid customer categories.

Financial Currency

Select the financial currency from the adjoining option list.

Mobile Number

Specify the mobile phone number of the prospective customer.

Landline Number

Specify the land phone number of the prospective customer.

Specify the e-mail Id of the prospective customer.

Fax

Specify the fax number of the prospective customer.

Preferred Date of Contact

Specify the preferred date of contact.

Preferred Time of Contact

Specify the preferred time of contact.

First Name

Specify the first name of the customer.

Middle Name

Specify the middle name of the customer.

Last Name

Specify the last name of the customer.

Salutation

Select the salutation preference of the customer from the drop-down list provided. You can select any of the following options:

- Mr

- Mrs

- Miss

- Dr

Gender

Select the gender of the customer from the drop-down list.

Date of Birth

Specify the date of birth of the customer or select the date by clicking the ‘Calendar’ icon provided.

Mother’s Maiden Name

Specify the customer’s mother’s maiden name.

Marital Status

Select the marital status of the prospective customer from the drop-down list. The following options are available:

- Married

- Divorced

- Remarried

- Separated

- Spouse Expired

Dependants

Specify the number of dependants for the customer.

SSN

Specify applicant’s SSN.

Passport Number

Specify the passport number of the prospective customer.

Passport Issue Date

Specify the date on which the customer’s passport was issued or select the date from by clicking the adjoining ‘Calendar’ icon.

Passport Expiry Date

Specify the date on which the customer’s passport expires or select the date from by clicking the adjoining ‘Calendar’ icon.

Existing Relationship Details

You can maintain the following relationship details:

Relationship Type

Specify the relationship type of the customer.

Credit Card Number

Specify the credit card number of the customer

Customer ID/Account Number

Specify the customer identification or account number of the customer.

Note

The system defaults the above details for both the prospect and the existing customer, if the application is submitted from external system.

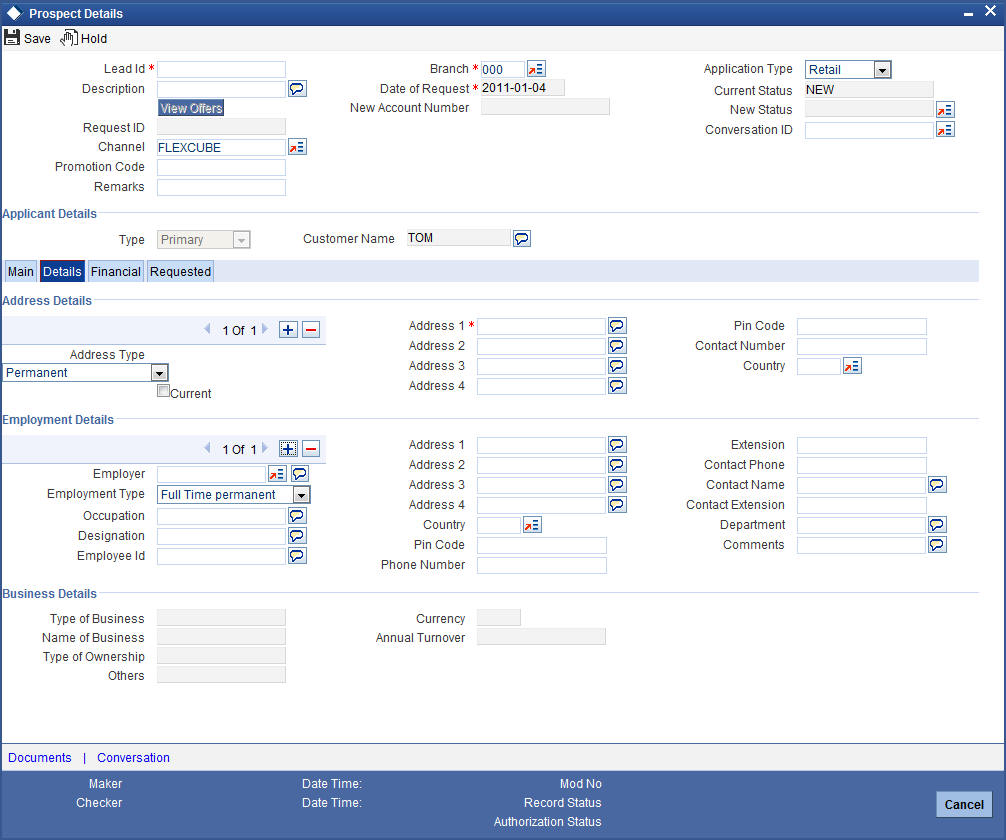

2.2.3 Details Tab

You can capture the address and employment related details of the prospective customer in ‘Details’ tab.

Address Details

Address Type

Select the address type of the customer from the following options provided in the drop-down list:

- Permanent

- Home

- Correspondence Address

Mailing

Check this box to indicate that the address you specify here is the customer’s mailing address.

Address Line 1 – 4

Specify the address of the customer in four lines starting from Address Line 1 to Address Line 3.

Pincode

Specify the zip code associated wit the address specified.

Contact Number

Specify the contact telephone number of the customer.

Country

Specify the country associated with the address specified.

Employment Details

Employer

Specify the name of the employer of the prospective customer.

Employment Type

Select the customer’s employment type from the drop-down provided. The following options are available:

- Part Time

- Full Time

- Contract Based

Occupation

Specify the occupation of the prospective customer.

Designation

Specify the designation of the prospective customer.

Employee Id

Specify the employee Id of the prospective customer.

Address Line 1 – 4

Specify the employment address of the customer in four lines starting from Address Line 1 to Address Line 4.

Country

Specify the country associated with the employment address specified.

Pincode

Specify the zip code associated with the office address specified.

Phone Number

Specify the official phone number of the prospective customer.

Extension

Specify the telephone extension number, if any, of the prospective customer.

Contact Phone

Specify the contact phone number of the customer’s contact person.

Contact Name

Specify the name of a contact person at the customer’s office.

Contact Extension

Specify the telephone extension number, if any, associated with contact person.

Department

Specify the department to which the customer belongs.

Comments

Specify comments, if any, related to the customer’s employment.

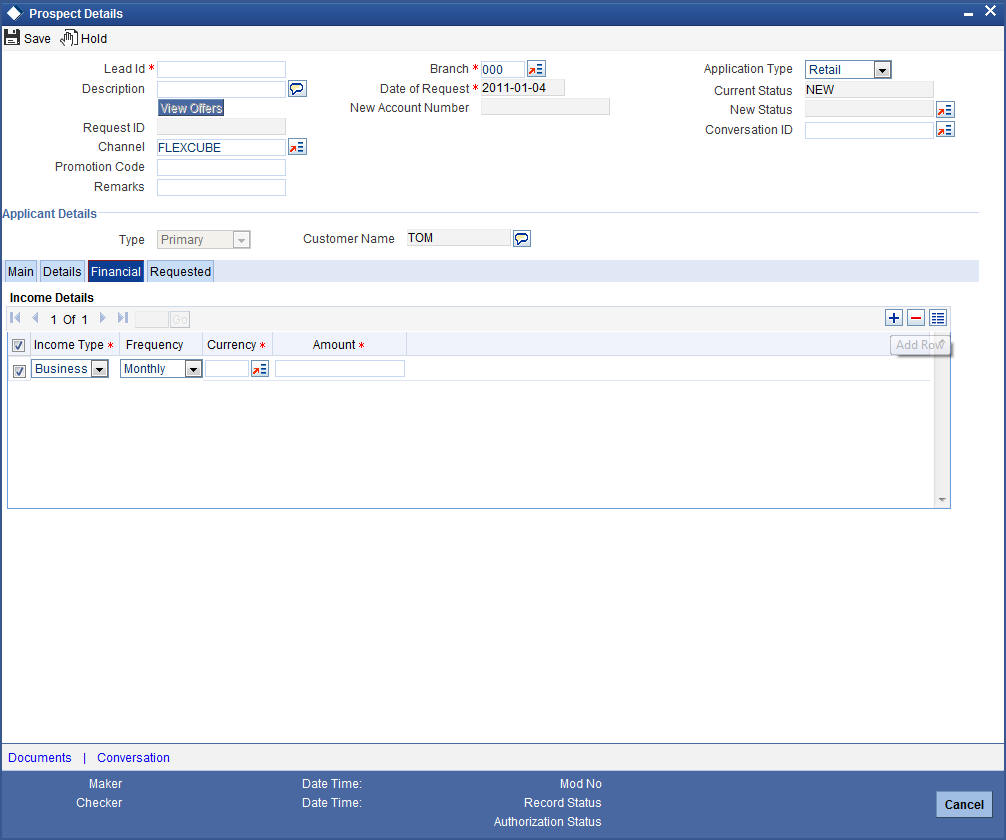

2.2.4 Financial Tab

You can capture the details related to the finance in the ‘Financial’ tab.

Income Details

Income Type

Select the income type from the adjoining option list.

Frequency

Select the frequency of the income of the applicant.

Currency

Select the currency of the income from the adjoining option list.

Amount

Specify the income amount.

2.2.5 Requested Tab

You can capture the details related to the requested CASA in ‘Requested’ tab.

You can capture the following details here:

Requested CASA Details

Note

This section is applicable only for CASA Lead origination.

Type of Account

The system displays the type of account.

Purpose of Account

The system displays the purpose of the account.

Overdraft Limit Required

Check this box if overdraft limit is required.

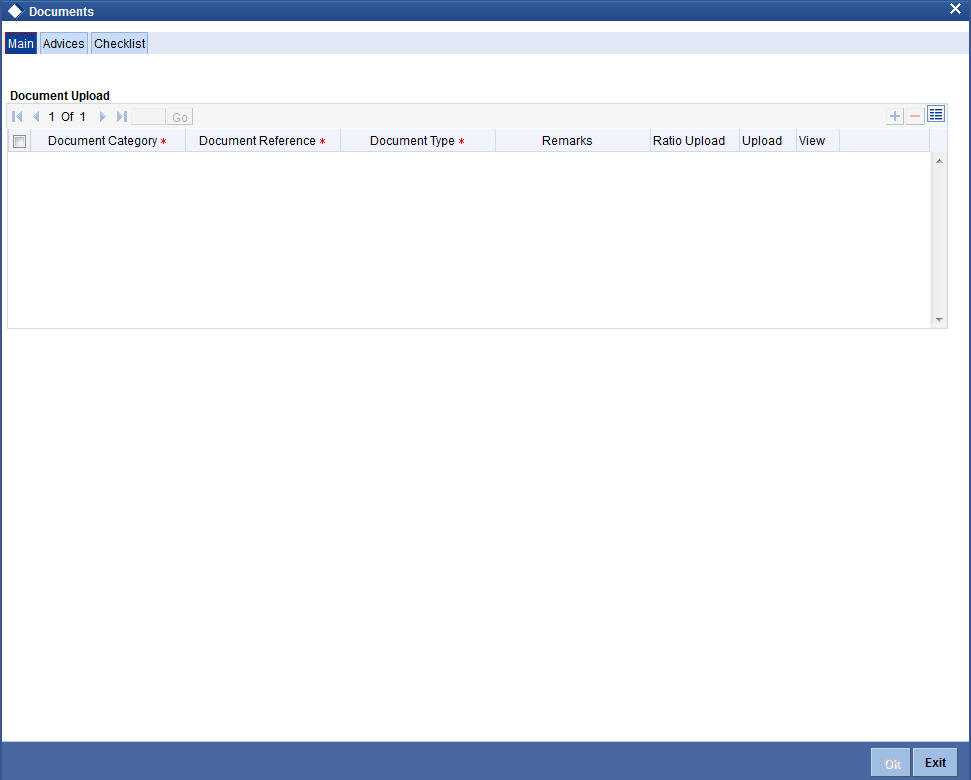

2.2.6 Document Details

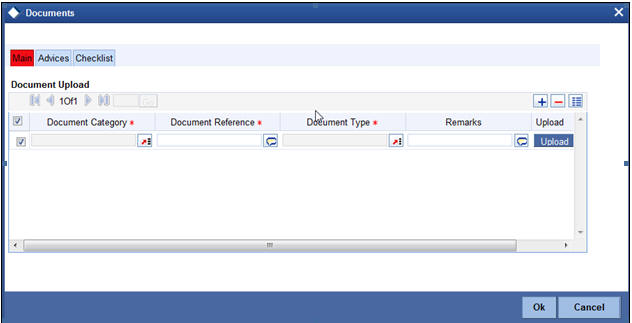

Click on ‘Documents’ link to invoke the Documents screen.You can upload the required documents from the external system.

Document Category

Select the document category from the adjoining option list.

Document Reference

Specify the document reference.

Document Type

Select the type of document from the adjoining option list.

Remarks

Specify remarks, if any.

Ratio Upload

Check this box to enable ratio upload.

Upload

Click on ‘Upload’ button to upload the document.

View

Click on ‘View’ button to view the uploaded document.

The document upload from the external system is allowed only when:

- the customer submits the account opening request from the external system

- the status in the Prospect Details screen is ‘Additional Documents Required’.

Note

The documents uploaded by the customer through the external system is stored in the Document Management System with a document reference number.

Status Related Process and Validation

The details of conditional listing of statuses required based on ‘Application Type’ and ‘Current Status’ combination in ‘Lead Maintenance’ screen are listed in the below table:

| Application Type | Process Code | Current Status | New Status Available | New Status Selected | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| CASA | LEAD | New (Default Status for a new record) | Follow Up | Rejected | Follow Up | Rejected | |||||

|

|

||||||||||

|

|

Follow Up | Under Process | Rejected | Under Process | Rejected | |||||

|

|

||||||||||

|

|

Under Process | Additional Doc Required | Account Opening in Progress | Rejected | Additional Doc Required | |||||

|

|

|

|

Account Opening in Progress | Rejected | ||||||

|

|

||||||||||

|

|

Additional Doc Required | Under Process | Rejected | Under Process | Rejected | |||||

|

|

||||||||||

|

|

Account Opening in Progress (Further process is done manually) | Converted | Rejected | Converted | Rejected | |||||

|

|

||||||||||

|

|

Account Opening in Progress (Further process is done through origination) | - | Origination in Progress (Automatic) | This status gets updated automatically once the lead ID is linked with Origination reference number. | ||||||

|

|

Origination in Progress | - | Converted (Automatic) Once the account is successfully opened in origination this status gets updated automatically | |||||||

|

|

Converted Rejected |

- - |

- - |

|||||||

|

|

- The default ‘Current Status’ for a new lead record will be ‘New’. In the ‘New Status’ field, the system lists the status based on the ‘Application type’, ‘Process Code’ selected and ‘Current Status’ of the record. The system enables you to proceed only when the new status you selected is applicable with respect to the current status. Else, the system displays the error message as “The status XXXXX cannot be chosen when the current status is XXXXX”.

- The system communicates the status along with the reason code to respective channels for each status change. When the status is updated as ‘Rejected’ or ‘Converted’, you cannot amend the lead record.

- The status ‘Converted’ and the field ‘New Account

Number’ are updated in lead record as listed below:

- If the account is created through origination flow (BPEL flow). then the system updates the lead record status as ‘Origination in Progress’. Then the lead ID is linked with the origination application reference number. On further flow when the account is created The system updates the ‘New Account Number’ in the Lead Maintenance screen with the newly created account number and changes the status as ‘Converted’.

- Alternatively, you can manually update the status as ‘Converted’. While updating the status as ‘Converted’ you must update the newly created account number also. Else, the system will displays an error message as "New Account Number to be entered".

- If the process flow is terminated for any reason, then the system updates the lead status as ‘Rejected’.

- You can link the lead ID with origination only when the current status of the lead record is ‘Account Opening in Progress’. The ‘Lead ID’ field in the origination screen will display a list of lead records which has the status as ‘Account Opening in Progress’.

2.2.7 Processing and Validating Fields in Lead Maintenance

The following are the steps involved to create an account using ‘Lead Maintenance screen. This section also briefs you on the validations related to few fields.

- Documents uploaded in external channels are stored in Document Management System and a reference number is created in system using which you can view the uploaded documents.

- Once the field level requirements are maintained the status definition needs to be maintained for lead management. The following features available in the system facilitate the status definition maintenance for lead management:

- A process code ‘LEAD’ maintained is maintained in the ‘Process Code Maintenance’ screen.

- Status definition is maintained based on the ‘Application Type’

and ‘Process Code’ combination, maintained in Customer Maintenance

and Lead Maintenance screens respectively. The system displays the following

values for selection:

- New

- Follow up

- Under Process

- Additional Doc Required

- Account Opening in Progress

- Converted

- Rejected

- Origination in Progress

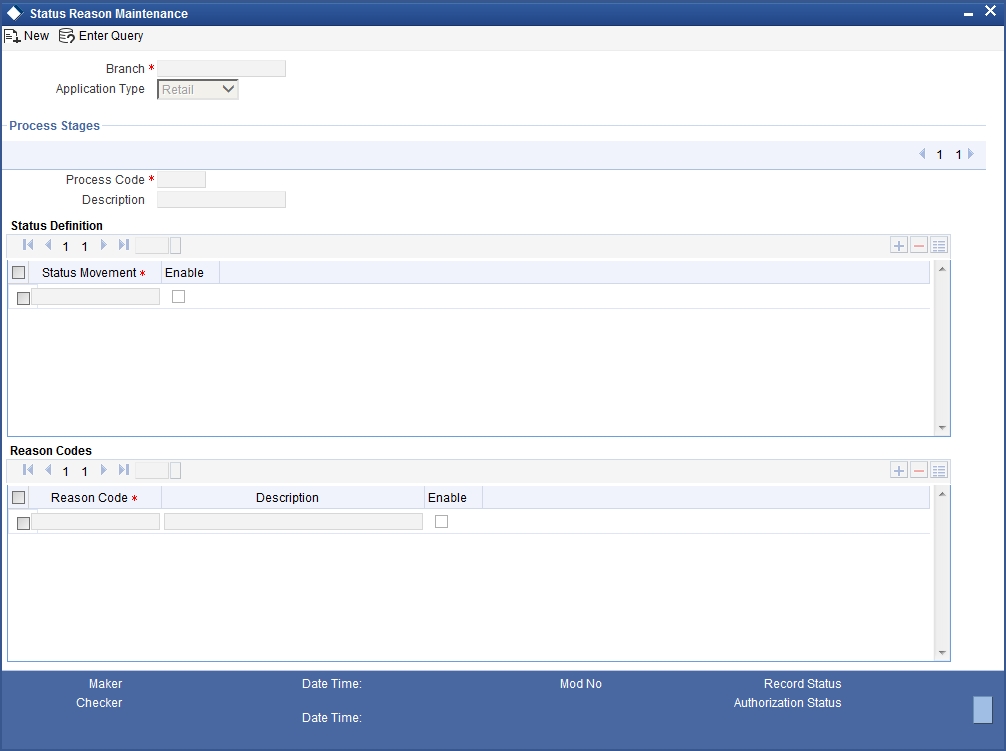

You can link different reason codes to status definition in the ‘Status Maintenance Screen’. Reason codes are linked based on the ‘Application Type’, ‘Process Code’ and ‘Status Definition’ combination. You can invoke this screen by typing ‘ORDSTRMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can maintain the following details:

Branch

The system the current branch code here.

Application Type

Select the application type you need to link to the status definition, from the adjoining drop-down list. The list displays the following values:

- CASA

- Retail

When the Application Type is ‘CASA’ and Process Code is ‘LEAD’, then the ‘Status Definition’ field displays the status values maintained in the system; however you can specify the values additional to the ones displayed. These values are stored in the database.

Process Stages

Process Code

Specify a valid process code you need to link to the status definition. The adjoining option list displays all valid process codes for the application type selected. Select the appropriate one.

Description

System displays the description of the selected process code.

Status Definition

Status Definition

Specify a valid status definition you need to link. Also, the adjoining option list displays all valid status definition for the process codes selected. You can select the appropriate one.

Enable

Check this box to enable status usage for the application type or process code.

Reason Codes

Reason Code

Specify a valid reason code you need to link. The adjoining option list displays all valid error codes maintained as ‘I’ at ‘Error Message Maintenance’ level are displayed here. Select the appropriate one.

You can link multiple reason codes to a status definition in this screen. However, it is mandatory to link at least a single reason code. This linking is extended to origination process codes also

Description

System displays the description of the selected reason code.

Enable

Check this box to enable status usage for the application type or process code.

Interaction

- Interaction between branch user and channel user is established using the interaction module in ‘Lead Maintenance’ screen and the Conversation ID is referred to as Interaction ID. Interaction ID for a prospect is branch walk-in customer ID. If a branch walk-in customer is not available, then the system displays an error message as "Walk-in Customer not Available for the Branch".

The ‘Reason Code’ and ‘Remarks’ details are sent to the channel, along with the status communication for a particular stage.

- Before submitting the lead request, you can initiate the interaction from channels. In such scenario interaction will be assigned to ‘Help Desk’ initially and then at later stage when customer chooses the branch, the system automatically changes the assignee to ‘All Roles’ for the customer chosen branch. The system defaults the User/Role field of the interaction as ‘Role’.

Note

Channel will send the Conversation ID along with the Request ID/Lead ID to the system, if interaction was initiated before the lead request is submitted.

- If the interaction is not started in channels even after the lead request is submitted, the branch user can initiate the interaction at any stage using the ‘Conversation’ button. The generated Conversation ID along with the Request ID/Lead ID is sent to respective channels for further conversation. However, the ‘Conversation ID’ once updated cannot be amended.

Validating Lead Maintenance Fields

The system validates if;

- For the application type CASA, the default current status for a new record is ‘New’.

- Based on the application type and current status are the ‘New Status’ values listed.

- Based on the new status value selected, are the reason codes linked to that status displayed in reason code field.

- If employment type is ‘Self Employed’ or ‘Other’, then are the fields under ‘Business Details’ header enabled. For all the other options, fields under ‘Business Details’ must be disabled.

- For ‘Part time’, ‘Full time’ and ‘Contract Based’ employment type, are the following fields enabled. For any other employment type they are disabled.

- Occupation

- Designation

- Employee id

- The fields under ‘Requested CASA Details’ must be enabled only when ‘Application Type’ is CASA.

- Overdraft Limit Required field must be enabled only when ‘Type of Account’ is selected as ‘Savings Account’.

2.2.8 Processing Lead Requests

You can receive the lead request from customer or prospects. The possible scenarios and the behavior of CIF ID for each scenario are explained below.

Scenario 1:

A prospect not holding any relationship with the bank raises a request from channels.

- In Applicant Details section of Lead Maintenance screen, ‘Existing’ check box will be unchecked.

- A new CIF ID is allocated to the prospect and is displayed in Customer Number field of Applicant Details section in Lead Maintenance screen.

- Once the lead is converted and if the new account is opened through BPEL route then the allocated CIF ID can be used.

- Once the lead is converted and if the new account is opened through manual CIF creation, then while opening an account opening, the allocated CIF ID needs to be released once the status of the lead is updated as converted.

Scenario 2:

An existing customer with FCDB login credentials can apply for a new account by logging into net banking.

- In Applicant Details section of Lead Maintenance screen, ‘Existing’ check box will be checked by default.

- Customer ID provided by the customer in channels is validated in channels and is displayed in Customer Number field of Applicant Details section in Lead Maintenance screen.

Scenario 3:

An existing customer without FCDB login credentials can apply for a new account by providing the existing relationship details and FCPB does not validate existing data.

- In Applicant Details section of Lead Maintenance screen, ‘Existing’ check box will be checked by default.

- Walk in Customer ID is computed by default in Customer Number field of Applicant Details section in Lead Maintenance screen.

- When the branch employee amends the lead record of walk-in customer ID, the system will display an error as “Invalid CIF, cannot amend a lead record as existing customer and customer ID is walk in ID".

Scenario 4:

An existing customer applies for an account as a prospect from FCDB without providing any existing relationship details. This procedure is similar to scenario 1.

Note

When the current status of the lead record changes to ‘Rejected’, then the CIF IDs blocked for the Scenarios 1 and 4 are released automatically by the system, so that the blocked CIF IDs can be re used.

Once the Lead request is approved and converted. customer account is created through any of these;

- BPEL - Refer Section 2.5, "Stages for Request Received through Branch (BPEL)"

- Opening an account through normal process

2.2.8.1 Opening an Account through Normal Process

The account opening through normal process comprises of the following stages

- CASA lead request submitted from channels

- Receive and verify account opening form and other documents

- Store documents

- Seek approval for missing documents / details

- Modify and resubmit the application

- Input details of savings account

- Verify prospect / customer details

- Modify details of savings account

- Know Your Customer checks

- Block customer in the system on negative Status of KYC check

- Notify prospect / customer on negative status of KYC checks

- Create / Modify customer details in the system

- Create Customer and Customer Account, if the request is from prospect and Create Customer Account, if the request is from existing customer

- Check available balance

- Generate cheque book in the system

- Issue Debit Card

- Generate welcome / thanks letter in the system

- Notify the customer/prospect about the successful account opening with details

- Deliver account kit to customer

- Store documents

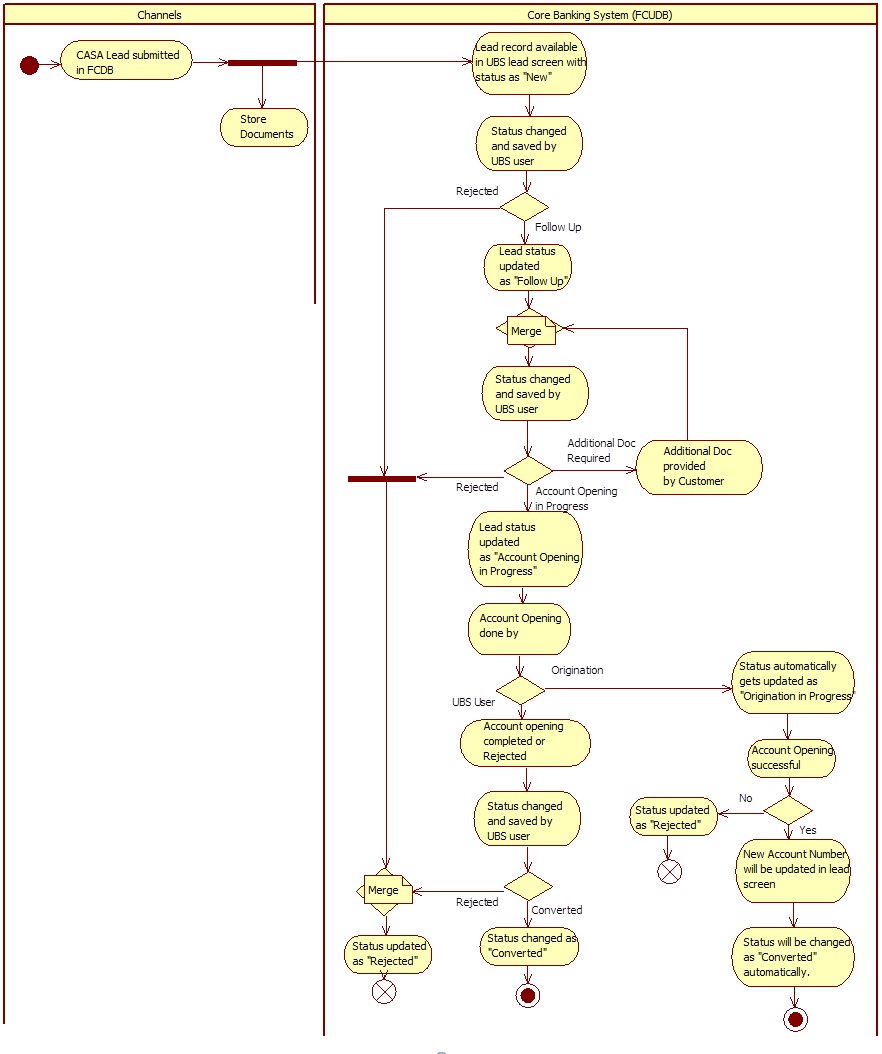

2.2.9 Lead Workflow Chart

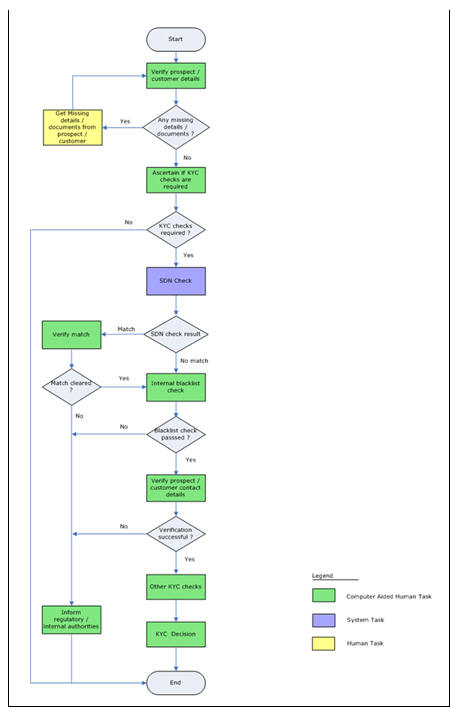

The below flow chart provides graphical flow of the process followed for lead requests:

2.3 Processing Requests through STP

When a prospect or customer requests to open account through STP, the system processes the request online. While opening an account through STP, the system processes the following:

- ‘FCUBSCustomerService’ is consumed by channels for opening customer number and account number for a prospects and ‘FCUBSACCService’ will be consumed by channels for opening customer account for existing customers

- Required Customer/Customer Account details are captured for prospect and required Customer Account details are captured for existing customer

- If a request is raised for cheque book, then the respective check box is checked and the requested number of leaves are provided.

- If a request is raised for debit card, then the respective check box is checked and the details of name on card are collected.

- If a request is raised for joint account, then the respective check box is checked and the details of the joint holder are collected.

- After successful creation of customer and account for prospects and account for customers, the system commutes the respective details to channels.

Processing Requests for Cheque Book

If Cheque Book check box is checked by customer in channels, then the system;

- Stores the check book details in ‘Main’

‘Account Facilities’

‘Cheque Book’ check box of ‘Customer Account Maintenance’ screen

- Stores the ‘Number of Leaves’ details in ‘Cheque

Book Request’

‘Cheque Leaves’ field of ‘Customer Account Maintenance’ screen

You can identify these accounts for which cheque book is requested on a particular date using advance search facility in the account maintenance summary level.

- Processes cheque issuance manually

Processing Requests for Debit Card

If Debit Card check box is checked by customer in channels, then the system;

- Stores the debit card details in ‘Main’

‘Account Facilities’

‘ATM’ check box of ‘Customer Account Maintenance’ screen

- Stores the ‘Name on Card’ details in ‘Debit

Card Request’

‘Name on Card’ field of ‘Customer Account Maintenance’ screen

You can identify these accounts for which Debit Card is requested on a particular date using advance search facility under ‘ATM Card’ field at the Account Maintenance Summary level.

- Processes Debit Card issuance manually

Processing Requests for Joint Account Opening

The system also facilitates opening an account for joint owners. The below combinations are supported:

- Prospect (Primary) + Prospect (Secondary)

- Existing Customer (Primary) + Existing Customer (Secondary)

- Existing Customer (Primary) + Prospect (Secondary)

Apart from adding joint holders in the account, the system handles the other processes similar to online account opening process.

If there are any failures in account creation process through, then the system notifies the channels and rolls back the entire process. The channels will then send new requests for further processing. For prospects, if the customer creation is successful and there are any failures in account creation, then the system rolls the entire process. However, you cannot rollback the process, if the customer account is created.

For opening an account through STP, the channels take care of the following activities:

- KYC validation

- Penny Credit Validation

- Initial Funding

After successful completion of the process, the system communicates ‘Customer Number’ and ‘Account Number’ to channels.

Handling Penny Credit Requests from Prospects.

- For prospects, walk in customer ID is used to create a PC contract.

- While the PC contract is created for a prospect branch walk-in, customer ID will be chosen automatically in PC screen. The prospect name will be displayed in customer name field instead of branch walk-in customer name in PC screen.

- In the PC contract remarks application, reference number of the origination and the customer name must be captured.

- Required internal system parameters can be set up to identify the response of penny credit validation. i.e., Parameter like ‘Maximum number of days’ for rejection of payment can be set up internally to track the response. For example: if the maximum number of days is set as '3'. If a rejection is not received within these three days, then the transaction can be considered as successful. If there is any rejection received within 3 days, then the transaction will be considered as failure.

- When there is a rejection of penny credit transaction, the ‘Contract Status’ of PC contract gets updated as ‘Rejected’ and the ‘Reject Details’ will get updated with data; like ‘Name’, ‘Bank’ and ‘Reference Number’. Using this information BPEL will track the rejection status of a PC contract accordingly. A notification ‘Penny Credit Transaction Rejected’ will be sent to channels.

- If a transaction is rejected due to any reasons, then the bank can decide whether the penny credit transaction can be re-initiated or not. If bank allows re-initiation, then the details provided by the customer can be re confirmed and transaction will be initiated again.

- On failure of penny credit transaction, if bank decides to terminate the request, then the origination process will be moved to bank user manual rejection task.

- When there is no rejection received for a penny credit transaction within the stipulated time, then the transaction will be considered as successful. Once the transaction is successful then a message "Penny Credit Transaction is Successful" will be sent to channels. BPEL will then move to next stage.

- In the next stage (STDCA074) bank will request the customer to key in the penny credit amount that has been credited in external bank account. The amount entered by the customer will be cross verified with the original amount sent to the account. Upon receiving the notification on penny credit successfully, channel will consume a web service to get the penny credit amount input from the customer.

- Upon successful validation of the penny credit amount, account origination will automatically move to next stage.

- In the next stage, if the penny credit amount entered by the customer is wrong, then the additional attempts can be allowed to re-enter the amount. Maximum number of attempts need to be pre-defined.

- If the customer has not responded to the penny credit amount validation stage for a particular period of time then the stage will be automatically moved to ‘Notify Prospect/Customer’ stage. The maximum number of days that the system will remain in ‘Penny Credit Validation Stage’ for the customer response can be pre-defined using internal system parameters.

- The penny amount debit will be parked into a bank GL, maintained at the PC product category level. On successful account opening, the penny amount needs to be deducted manually from the initial funding of the new account and credits to the bank GL.

- If the penny credit amount is not validated by the customer correctly due to which the process is terminated, then the penny credit amount needs to be recovered manually from customer.

- If initial funding option is not selected but still bank wants to perform the penny credit validation then the penny credit amount needs to be recovered from the customer manually.

- The system enables initiation of origination cancellation by customer. However, the available data is stored in the system for future reference. The system provides a service which can be utilized by channels to send the request for termination. When termination request is received through the service, the system will automatically terminate the origination workflow. Termination of workflow will be possible only before the following stages.

- For prospects, customer initiated cancellation will be supported before customer creation stage. Once customer is created, the system disables cancellation of origination.

- For customers, customer initiated cancellation will be supported before account creation stage. Once the account is created, the system disables termination of the workflow.

- It will be possible to generate a report on account opening requests that are raised through specific channels along with its latest status.

2.4 Channel Workflow Chart

The below flow chart provides graphical flow of the process followed for channel requests

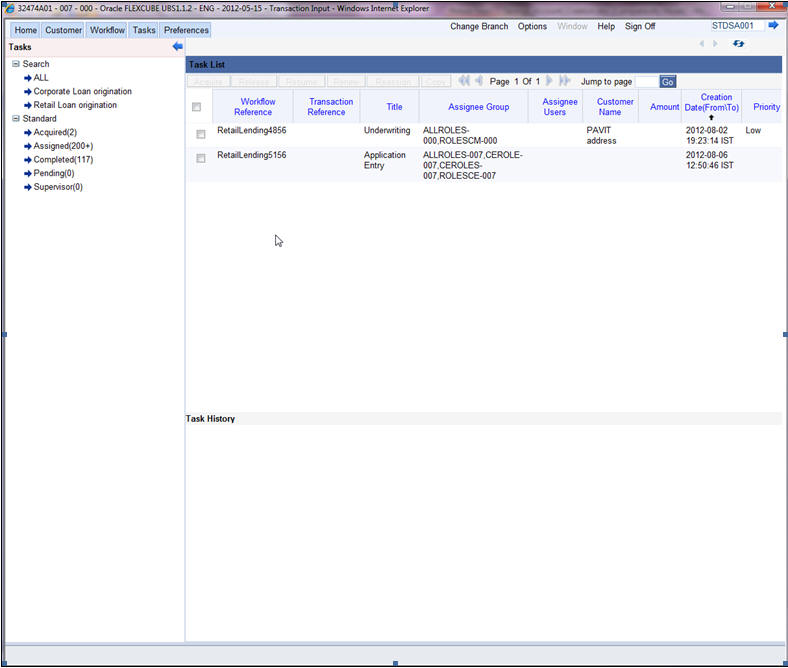

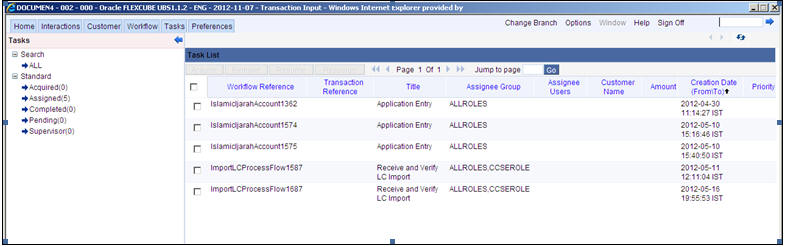

2.5 Stages for Request Received through Branch (BPEL)

In Oracle FLEXCUBE, the process for opening a savings account is governed by several user roles created to perform different tasks. These tasks are categorized to different stages. Stages fo opening a savings account are almost similar, with few exceptions. At every stage, the users (with requisite rights) need to fetch the relevant transactions from their task lists and act upon them. Similarly, at different times, the system will make calls to certain web services to process the transaction.

This section contains the following topics:

2.5.1 Stages in Account Opening Process

The account opening process comprises the following stages:

- Receive and verify account opening form and other documents

- Seek approval for missing documents / details

- Approve Account Opening (The combination of above two stages. If the request is submitted directly to BPEL by external channel, then the system begins the process this stage skipping the above.)

Note

If the Application is from Lead the process begins from the first stage and the stage 'Approve Account opening is not used.

- Store documents

- Modify and resubmit the application

- Input details of savings account

- Verify details of savings account

- Verify Prospect / Customer

- Sub process – Know your customer checks

- Block customer in Oracle FLEXCUBE

- Initiate Penny Credit Validation

- Modify Penny Credit Details

- Validate Penny Credit Amount

- Notify prospect / customer on negative status of KYC checks

- Create / Modify customer details in Oracle FLEXCUBE

- Create account in Oracle FLEXCUBE

- Store document reference in Oracle FLEXCUBE

- Check available balance

- Generate cheque book in Oracle FLEXCUBE

- Issue Debit Card

- Retrieve pre-printed cheque book and capture cheque book details

- Generate welcome / thanks letter in Oracle FLEXCUBE

- Notify the customer/prospect about the successful account opening with details

- Deliver account kit to customer

- Store documents

Only users who have procured the relevant access rights can perform activities under a stage.

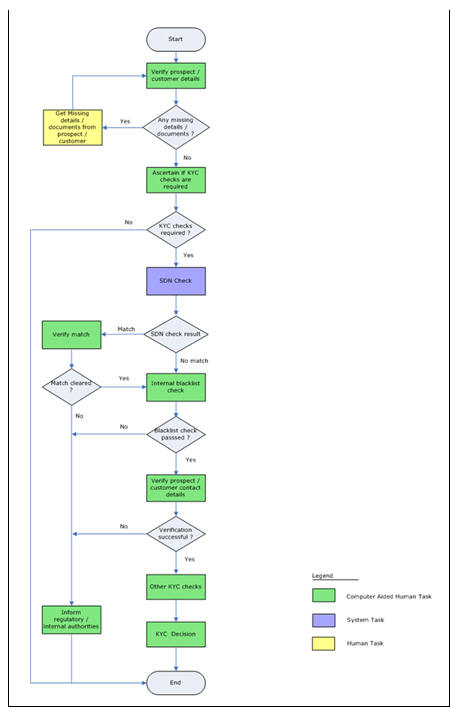

2.5.2 BPEL Flow Diagram

2.6 Receive and Verify

This section contains the following topics:

- Section 2.6.1, "Receive and Verify Account Opening Form and Documents"

- Section 2.6.2, "Capturing Primary Customer Details"

- Section 2.6.3, "Specifying MIS Details"

- Section 2.6.4, "Specifying User Defined Fields"

- Section 2.6.5, "Capturing Personal Details"

- Section 2.6.6, "Capturing Domestic Details"

- Section 2.6.7, "Capturing Professional Details"

- Section 2.6.8, "Capturing Secondary Customer Details"

- Section 2.6.9, "Capturing Tertiary Customer Details"

- Section 2.6.10, "Capturing Signatory Details"

- Section 2.6.11, "Uploading Documents"

2.6.1 Receive and Verify Account Opening Form and Documents

In this stage, the bank receives the required documents from the customer for opening savings account, they are checked for completeness. If any documents are missing, the bank will get the documents from the prospect / customer before proceeding further or the bank will seek an approval from the appropriate internal authority for processing the account opening request without the complete set of documents / details as an exception. The basic details like customer information, customer contact information, details of account to be opened and the list of documents obtained from the customer are captured and the account opening form and all other documents received from the prospect / customer are uploaded as part of this activity.

The basic details like customer information, customer contact information and the details of account to be opened and the list of documents obtained from the customer are captured.

Users belonging to the user role RCSEROLE (Retail Customer Service Executive) can perform these activities.

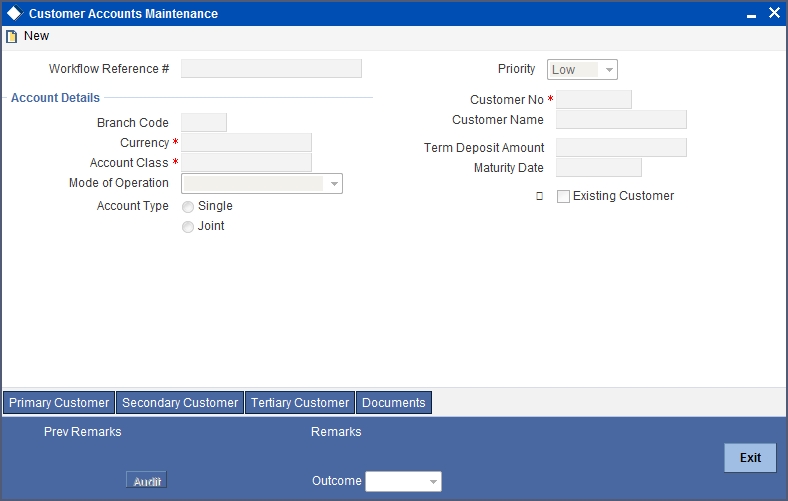

Specify the following basic details in this screen:

Application Category

Specify the application category from the adjoining option list.

Application Number

System generates the application number at the account opening stage. This number remains unique till the last stage.

Lead ID

Specify a valid Lead ID for which you need to create the account. The adjoining option list displays a list of valid lead ID. Select the appropriate one.

Branch Code

System displays the logged in branch code.

Status

System displays the status of the application.

Date

System displays the application date.

Priority

Select the priority for the creation of the savings account for a customer from the adjoining drop-down list. This list displays:

- Low

- Medium

- High

The option selected in this field is displayed in tasks search screen on following stages of account creation. The system supports the feature to list the records in the desired order. E.g. If the user prefers to list instance records in the order of ‘High’ priority to appear first the same will be feasible by clicking the column priority in task search screen and second attempt of the same will list in the vice-versa order as shown in the below given screen:

Account Details

Capture the basic account details of the customer here:

Account Branch

The current logged in branch is displayed here.

Account Currency

Specify the currency of the customer account. You can also select the appropriate currency from the adjoining option list. The list displays all the valid currencies maintained in the system.

Account Class

Specify the account class to be used by the account. You can also select the appropriate account class from the adjoining option list. The list displays all the valid account classes maintained in the system. You can choose the appropriate one.

Mode of Operation

Select mode of operation from the drop-down list. The options available are:

- Single

- Jointly

- Either – Any one or Survivor

- Former or Survivor

- Mandate Holder

Account Type

Select the account type from the drop-down list. The options available are:

- Single

- Joint

Customer Details

Local Branch

Specify the local branch code.

Customer Number

This field is enabled only if the customer is an existing customer. Specify a valid customer number. You can also select the appropriate customer number from the adjoining option list. The list displays all valid customers maintained in the system.

Customer Name

The name of the selected customer is displayed here.

Existing Customer

Check this option if the selected customer is an existing customer.

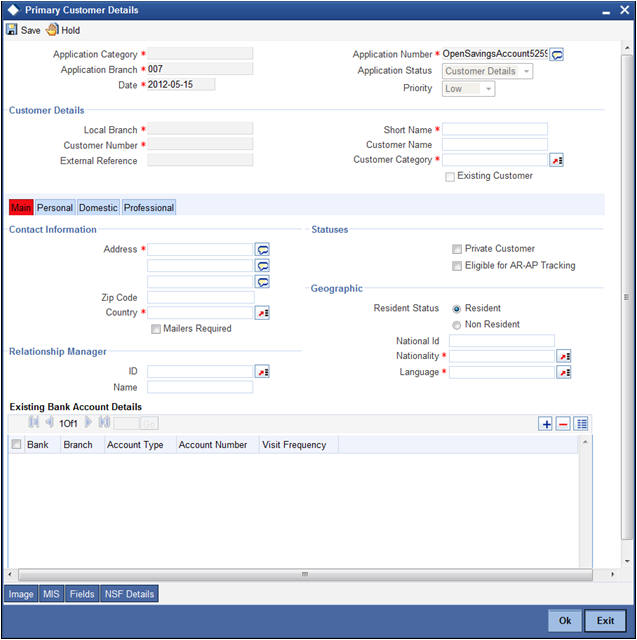

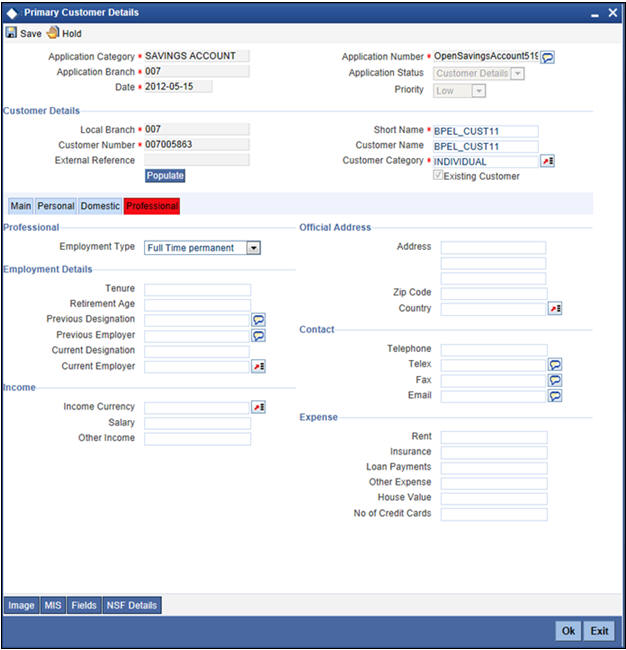

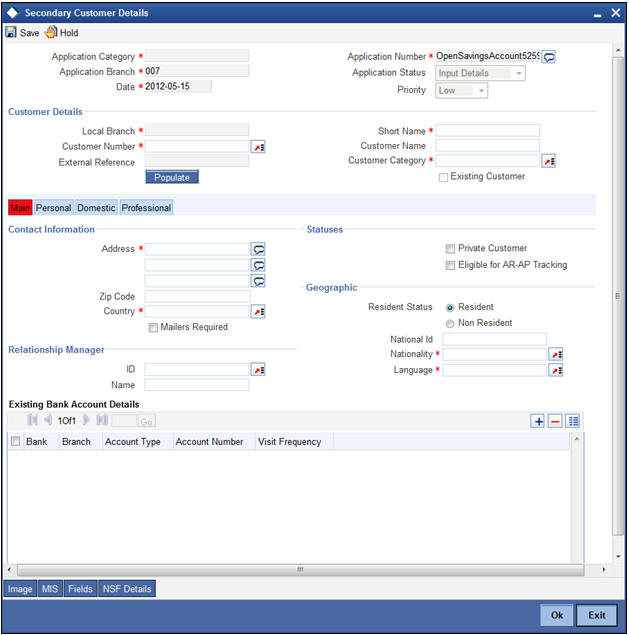

2.6.2 Capturing Primary Customer Details

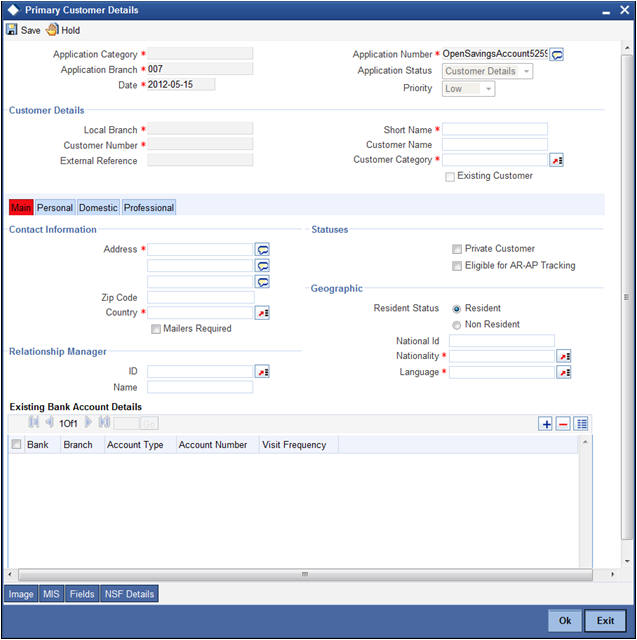

Click ‘Primary Customer’ button to capture customer details. The following screen is displayed:

Here you can maintain the following details:

Contact Information

Adderss

Specify the address of the customer.

Zip Code

Specify the zip code for the customer address.

Country

Specify the country in which the customer resides from the option list.

Mailers Required

Check this if the customer has chose to receive mailers.

Statuses

Private Customer

Check this box to indicate that the customer is a private type of customer.

Eligible for AR-AP Tracking

Check this box to indicate that the account receivable and account payable process is to be enabled for this customer.

Permanent US Resident Status

Check this box to indicate that the corresponding director is a permanent US resident.

Visited US in last 3 years?

Check this box to indicate that the beneficial owner has visited US in the last three years.

Geographic

Resident Status

Indicate the customer’s resident status. The options are as given below:

- Resident

- Non Resident

National Id

Specify the national Id of the customer.

Nationality

Specify the nationality of the customer. You can also select the nationality of the customer from the adjacent option list. The list displays a list of countries maintained in the system.

Language

As part of maintaining customer accounts and transacting on behalf of your customer, you will need to send periodic updates to your customers in the form of advices, statement of accounts and so on.

Indicate the language in which your customer wants the statements and advices to be generated.

Power of Attorney

Note

If the FATCA is enabled at the bank and the check box 'Power of Attorney' is checked here, then it is mandatory to specify the Power of Attorney information.

Power of Attorney

Check this box to indicate that the customer account is to be operated by the power of attorney holder.

Holder Name

The person who has been given the power of attorney.

Address

Specify the address of the power of attorney holder.

Country

Specify the country of the power of attorney holder.

Nationality

Specify the nationality of the power of attorney holder.

Telephone ISD Code +

Specify the international dialling code for the telephone number of the power of attorney holder. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Telephone Number

Specify the telephone number of the power of attorney holder.

Additional Details

Preferred Date of Contact

Specify the preferred date for contacting the customer. You can also select the date from the adjoining calendar icon.

Preferred Time of Contact

Select the preferred time for contacting the customer on the preferred date of contact, from the adjoining drop-down list. This list displays the following time slots in 24hrs format:

- Any time

- 1 hour combination of timings starting from 12am – 1am to 23pm – 12am.

Existing Bank Account Details

If the customer is an existing customer you ned to specify the following details:

Bank

Specify the name of the bank in which the customer is holding an account.

Branch

Specify the branch where the customer holds an account.

Account Type

Specify the type of account to be created.

Account Number

Specify the existing account number.

Visit Frequency

Specify the number of times the customer visits or transacts with the existing bank.

2.6.3 Specifying MIS Details

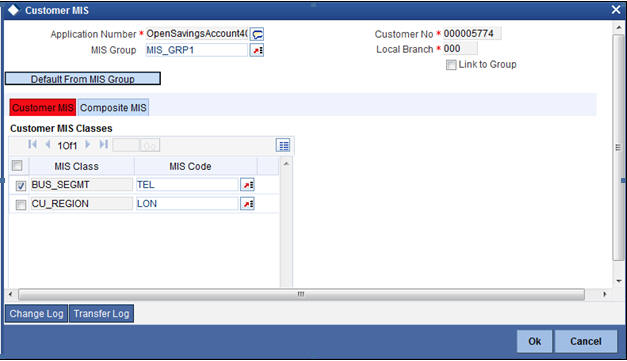

Click ‘MIS’ button to specify the MIS details. The ‘Customer MIS’ screen is displayed:

2.6.4 Specifying User Defined Fields

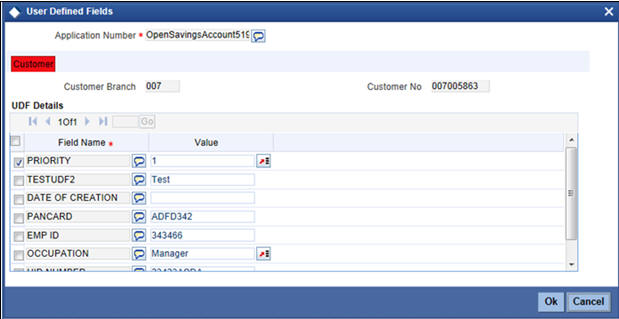

Click ‘UDF’ button to upload the documents. The ‘User Defined Fields’ screen is displayed:

2.6.5 Capturing Personal Details

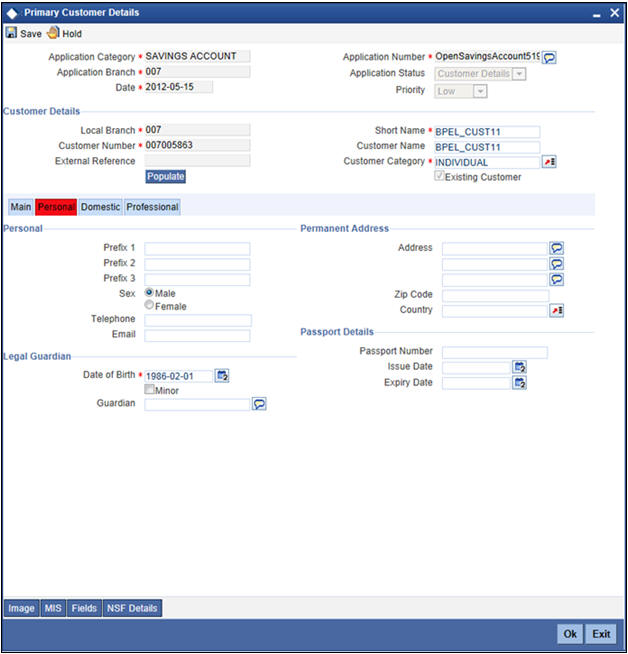

Click ‘Personal tab to capture personal details. The following screen is displayed:

Personal

Prefix1-3

Specify prefix for the customer name

First Name

Specify first name of the customer.

Middle Name

Specify middle name of the customer.

Last Name

Specify last name of the customer.

Work Phone

Specify a valid office phone number of the customer.

Home Phone

Specify a valid home phone number of the customer.

Specify a valid e-mail ID of the customer for correspondence.

Mobile Number

Specify a valid mobile number of the customer.

Gender

Select a valid gender of the customer from the options. The following options are available for selection:

- Male

- Female

- Other

- Prefer Not to Disclose

Permanent address

You can specify the permanent address details here:

Address1-4

Specify the permanent address of the customer.

Pincode

Specify the pin code of the permanent address.

Passport Details

You can specify the passport details here:

Passport Number

Specify a valid passport number of the customer.

Issue Date

Specify the date on which the specified passport was issued from the adjoining Calendar icon.

Expiry Date

Specify the expiry date of the specified passport from the adjoining Calendar icon.

Legal Guardian

You can specify the legal guardian details here:

Date of Birth

Specify date of birth of the legal Guardian

Minor

Check the box if the customer is a Minor.

Guardian

Specify the details of the legal guardian.

2.6.6 Capturing Domestic Details

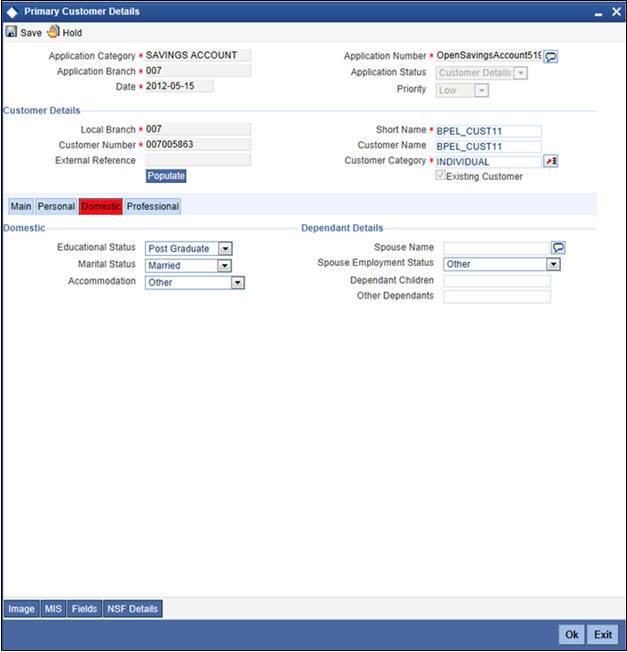

Click ‘Domestic’ tab to capture domestic details. The following screen is displayed:

Domestic

Educational Status

Select the educational status from the adjoining drop-down list. Available options are:

- Non Student

- Under Graduate

- Graduate

- Post Graduate

Marital Status

Select the marital status from the adjoining drop-down list. Available options are:

- Single

- Married

- Divorced

- Remarried

- Separated

- Spouse Expired

Accommodation

Select the accommodation type from the adjoining drop-down list. Available options are:

- Self Owned

- Company Provided

- Other

Dependant Details

Spouse Name

Specify the spouse name of the customer.

Spouse Employment Status

Select the spouse employment status from the adjoining drop-down list. Available options are:

- Full Time Permanent

- Full Time Temporary

- Self Employed

- Unemployed

- Retired Pensioned

- Part Time

- Retired Non Pensioned

- Other

Dependent Children

Specify the number of dependent children.

Other Dependants

Specify the number of other dependants, if any.

2.6.7 Capturing Professional Details

Click ‘Professional’ button to capture professional details. The following screen is displayed:

Professional

Employment Type

System displays the employment type here.

Official Address

Address

Specify the office address of the customer.

Zip Code

Specify the zip code of the customer’s office address.

Country

Specify the country name for the customer’s office address.

Employment Details

Tenure

Specify the tenure of the employment.

Retirement Age

Specify the age of retirement for the customer.

Previous Designation

Specify the previous designation of the customer.

Previous Employer

Specify the name of the previous employer.

Current Designation

Specify the current designation of the customer.

Current Employer

Specify the name of the current employer.

Income

Income Currency

Specify the currency in which the customer is paid.

Salary

Specify customer’s salary.

Other Income

Specify customer’s other income, if any.

Contact

Telephone

Specify the telephone number of customer’s office.

Telex

Specify the telex number of customer’s office.

Fax

Specify the fax number of customer’s office.

Specify the email id of customer’s office.

Expense

Rent

Specify the rent amount if the customer is staying in the rented house.

Insurance

Specify the insurance policies the customer possesses.

Loan Payment

Specify the loan amount if the customer is paying any loan.

Other Expense

Specify other expenses, if any.

House Value

Specify the value of the houe customer resides.

Number of Credit Cards

Specify the number of credit cards the customer holds.

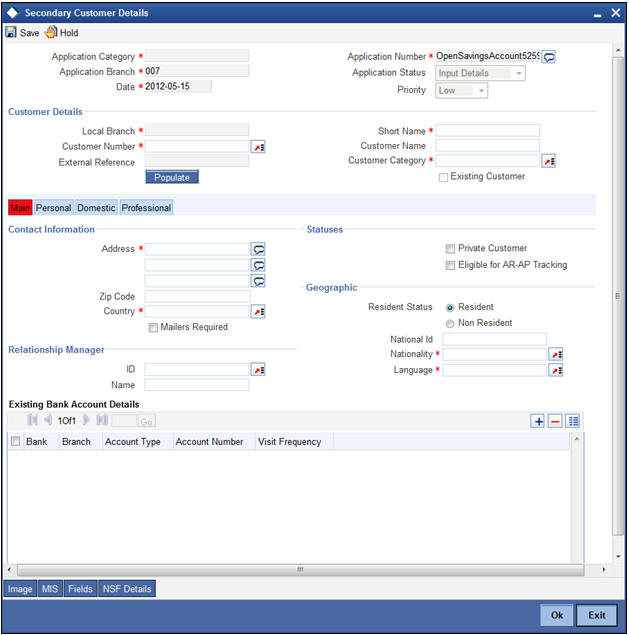

2.6.8 Capturing Secondary Customer Details

Click ‘Secondary Customer’ button to capture customer details. The following screen is displayed:

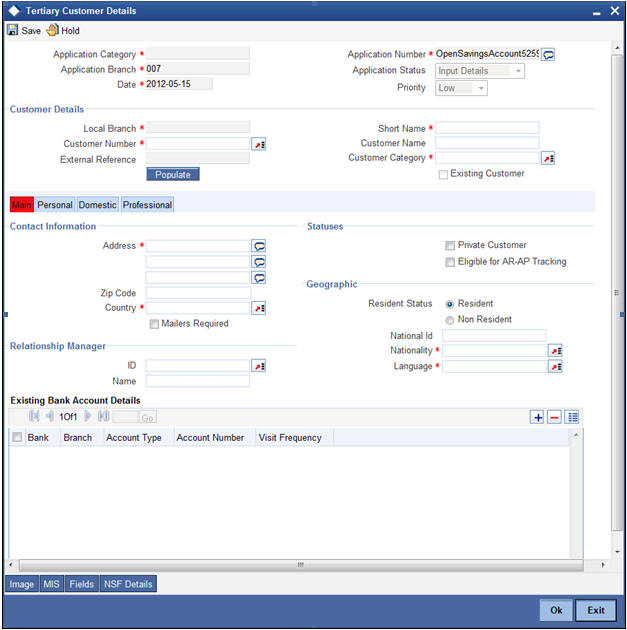

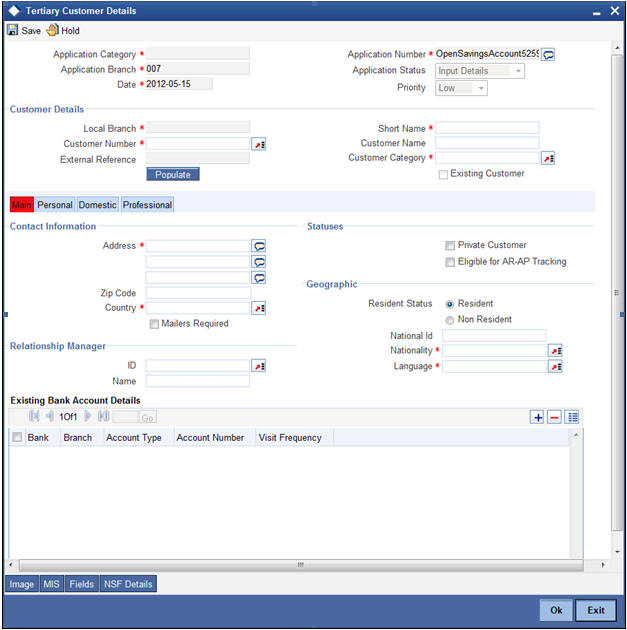

2.6.9 Capturing Tertiary Customer Details

Click ‘Tertiary Customer’ button to capture customer details. The following screen is displayed:

For further details on the fields displayed on this screen, refer to the section ‘Primary Customer Details’ in this chapter.

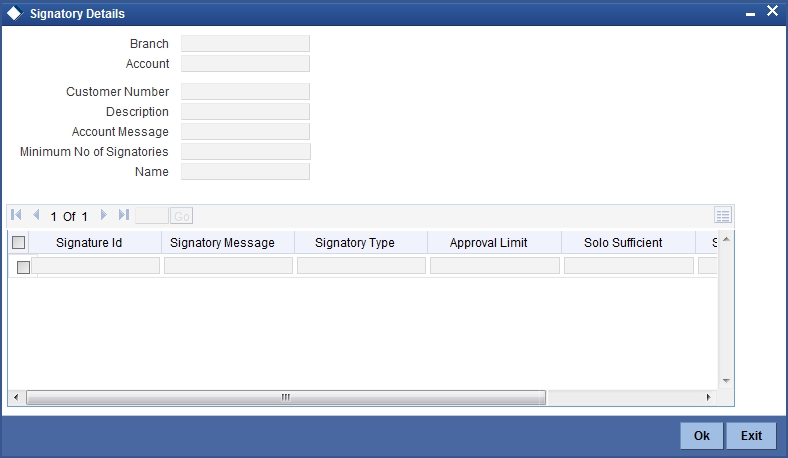

2.6.10 Capturing Signatory Details

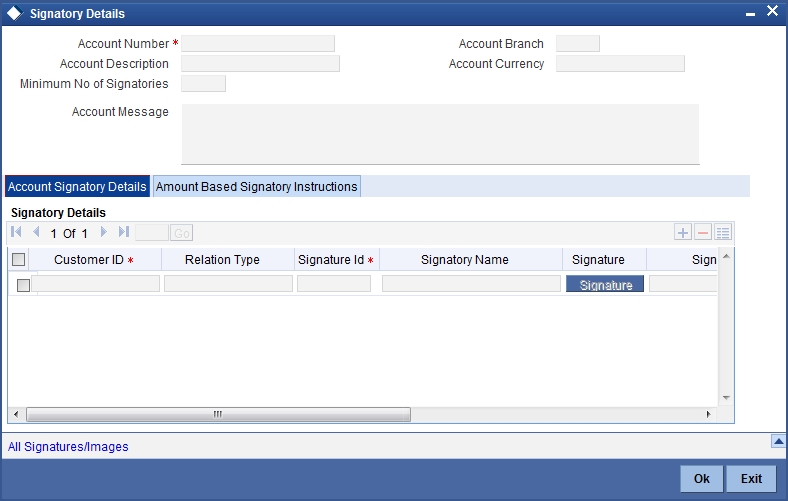

Click ‘Account Signatory’ button to invoke the ‘Signatory Details’ screen.

Here you can capture the following details:

Account Branch

The system defaults the current branch here.

Account Number

This system displays the account number to which signatories are to being linked.

Account Description

The system displays the description for the account selected.

Account Currency

The system displays the account currency.

Minimum Number of Signatories

Specify the minimum number of signatories necessary to endorse an instrument involving the account.

Note

If the linked or replicated signatories are less than the specified minimum number then the system displays an error message.

Account Message

Specify a brief description about particular signatories. It can be related to the name, number and the type of signatory of your customer. You can specify a maximum of 4000 characters as account message length.

For instance you can capture a message like - "This signatory is a joint account holder with rights to sign instruments only up US 8000".

2.6.10.1 Account Signatory Details Tab

You can maintain account signatory details for different customers using this tab.Click on ‘Account Signatory Details’ tab to invoke the following screen

Customer ID

Specify the customer signatory you want to link to the account.

You can link a customer signatory to an account either by:

- Click on the option list next to the Signatory Number. A list of customer signatory numbers, whose details have been captured will be displayed, along with their names. Pick up the signatory whom you want to make an account signatory for the account

- Keying-in the customer Signatory Number and Name directly, if the signatory number has not been maintained through the Customer Signatory details screen

- If the check box 'Replicate Signature' is checked in account level the signature details will be defaulted from the customer maintenance; however you are allowed to add/remove signatories manually.

Note

If the signatory ID that you specify has not been maintained, the system will generate an error and you will not be able to create an account.

Relation Type

The system displays the relation type of the customer.

Signatory ID

Specify the signatory ID of the customer. Alternatively, you can select the ID from the option list. The list displays values maintained in CIF signatory for the customer number.

Signatory Name

The system displays the corresponding name of the signatory number specified.

Signature Type

Specify the signatory type of the customer. Alternatively, you can select the type from the option list. The list displays signatory types maintained for the customer number.

Approval Limit

Specify the amount up to which the account signatory can approve for debits.

Signatory Message

Specify additional signatory message details in this field. You can enter a maximum of 4000 characters, alphanumeric.

Solo Sufficient

Check this box to indicate whether one signatory detail is sufficient.

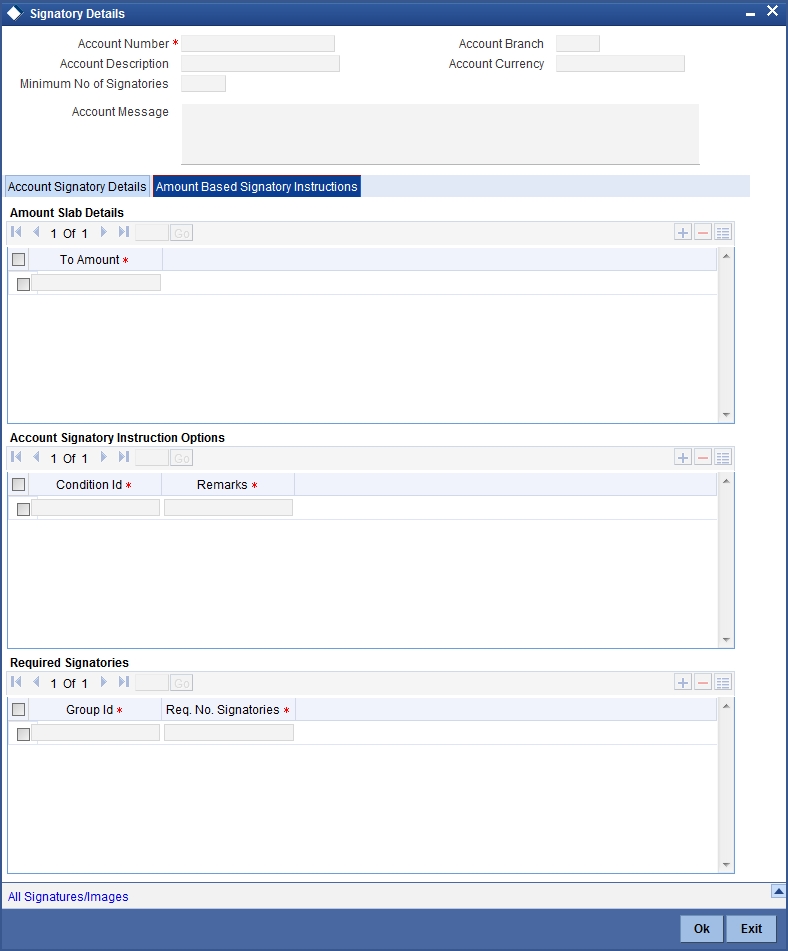

2.6.10.2 Amount Based Signatory Instruction Tab

You can maintain account signatory instructions for different amount slabs in this tab.Click on ‘Amount Based Signatory Instruction, tab to invoke the following screen:

Amount Slab Details

To Amount

Specify the slabs by setting a ‘To Amount’. The amount slab will start from zero and the first value entered sets the slab from zero to that amount. The amounts are arranged in ascending order. For next slab, an amount above the previous ‘To Amount’ is considered as the ‘From’ value.

For example, If the ‘To Amount’ entered are as below

| To Amount | |

|---|---|

| 10,000 | |

| 100,000 | |

| 1,000,000 |

Then the maintenance will indicate the below amount slabs:

| From Amount | To Amount | ||

|---|---|---|---|

| 0 | 10,000 | ||

| Above 10,000 | 100,000 | ||

| Above 100,000 | 1,000,000 |

Account Signatory Instruction Options

You can define different conditions for the amount slabs in this section.

Condition Id

Specify a unique Id for condition to be set.

Remarks

Give a brief description for the condition id.

Required Signatories

You can provide the required signatories for the conditions set in this section.

Signature Type

Select the signature type required from the option list. The list displays the signature types maintained in static type maintenance screen.

Note

The signature type cannot be repeated for a condition.

Required No. of Signatories

Specify the number of signatories for each signatory type.This number should be less than or equal to the total number of signatories maintained under the signatory type.

Note

The Amount Based Signatory Instructions tab will be enabled in the following RT screens only if the value of param ‘AMOUNT_BASED_SV’ is Y in CSTM_BRANCH_LOC_PARAMS.

- Cash Withdrawal (1001)

- Account to Account Transfer (1006)

- Miscellaneous Customer Debit (1008)

- TC Sale against Account (1009)

- BC Issue against Account (1010)

- Cheque Withdrawal (1013)

- DD Issue against Account (1014)

- Bill Payment Against account (1075)

- Account Close Out Withdrawal by BC (1300)

- Close Out Withdrawal (1301)

- Multimode Deposit Redemption (1317)

- Account Close Out Withdrawal (1320)

- Account Close Out Withdrawal by Multi Mode (1350)

- Cash Transfer (1405)

- Inward Clearing Data Entry (5555)

- FX Sale Against Account (8206)

- TT Issue against Account (8318)

- DD Issue against Cheque (8330)

- BC Issue against Cheque (8335)

- In House Cheque Deposit (LOCH)

- Payment by in house cheque (1045)

2.6.10.3 All Signatures/Images button

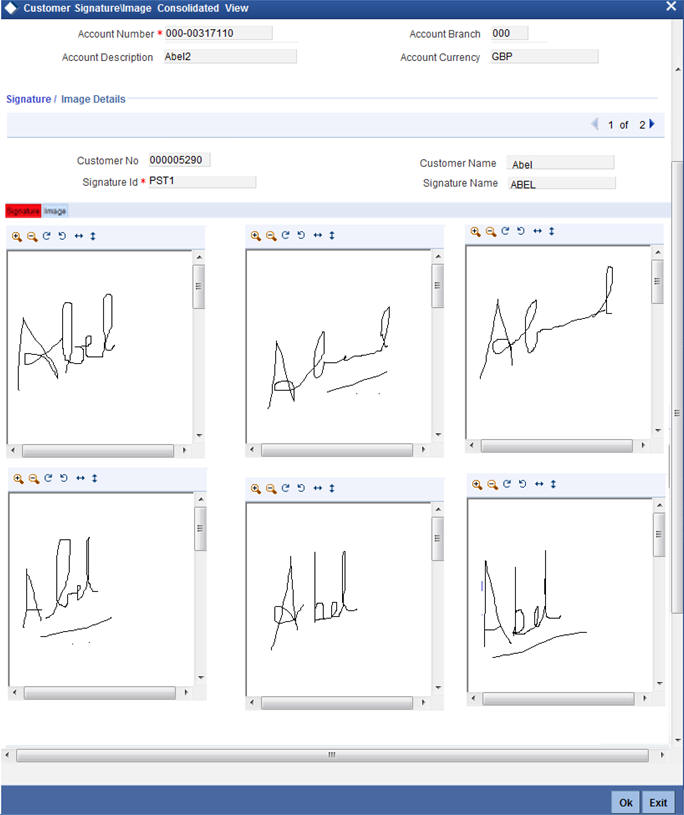

Click ‘All Signatures/Images’ button to view ‘Customer Signature/Image Consolidated View’ screen.

The following details will be displayed in the above screen

- Account Number

- Account Branch

- Account Description

- Account Currency

- Customer Number

- Signature Id

- Signature Name

The ‘Signature/Image’ tab displays nine signatures/Images for a signature id in a single pane with three signatures/Images in a row.

If there is more than one signature id linked to a customer account, then they would be displayed in different pages.

Each image is provided with the following buttons:

- Zoom In

- Zoom Out

- Rotate Clockwise

- Rotate Anticlockwise

- Flip Horizontal

- Flip Vertical

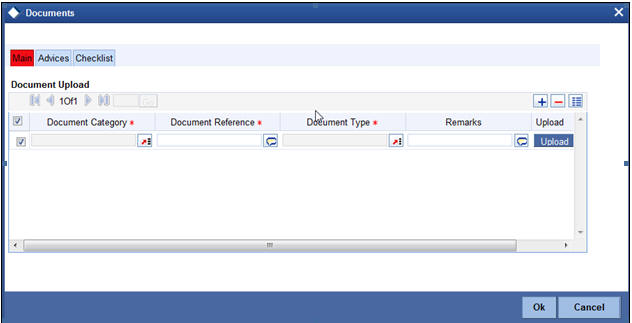

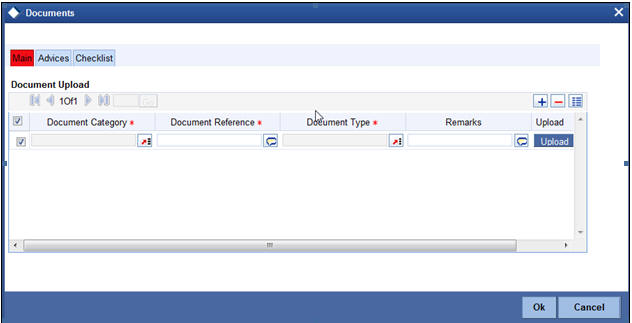

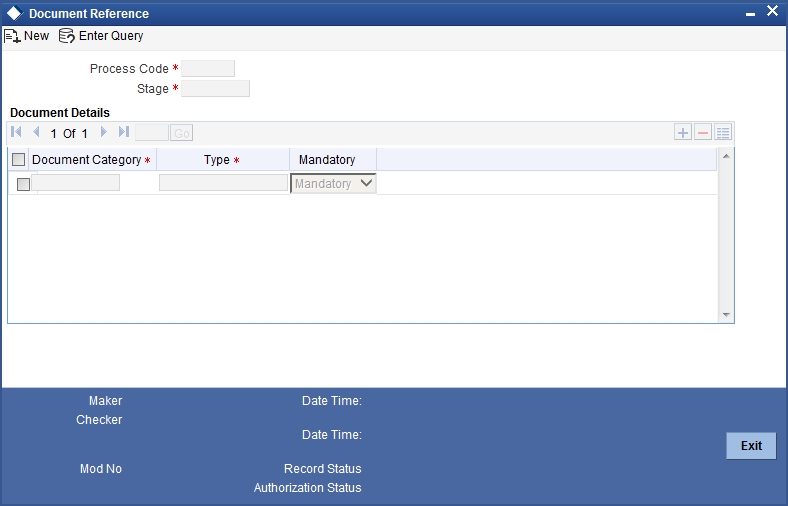

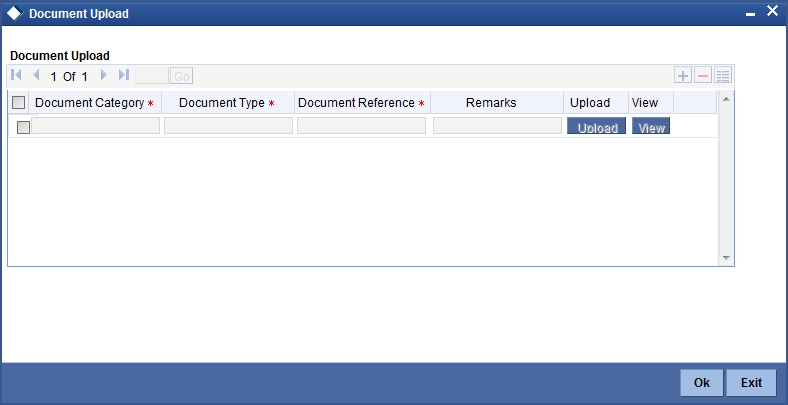

2.6.11 Uploading Documents

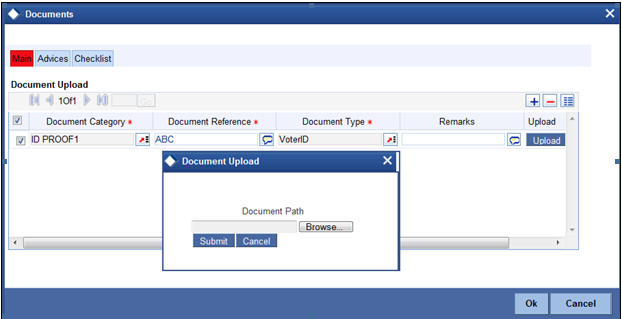

You can capture the customer related documents in central content management repository through the ‘Documents’ screen. Click ‘Documents’ button to invoke this screen.

Here, you need to specify the following details:

Document Category

Specify the category of the document to be uploaded.

Document Reference

The system generates and displays a unique identifier for the document.

Document Type

Specify the type of document that is to be uploaded.

Upload

Click ‘Upload’ button to open the ‘Document Upload’ sub-screen. The ‘Document Upload’ sub-screen is displayed below:

In the ‘Document Upload’ sub-screen, specify the corresponding document path and click the ‘Submit’ button. Once the document is uploaded through the upload button, the system displays the document reference number.

View

Click ‘View’ to view the document uploaded.

In ‘Savings Account Creation’ process, ‘Document Upload’ feature is not available in all the stages. Its availability in this process is given below:

| Stage Title | Function Id | Callform exists | Upload(Available/Not available) | View(Available/Not available) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Receive and verify account opening form and other documents | STDSA001 | Available | Available | Available | ||||||

| Seek approval for missing documents / details | STDSA002 | STDSA080 | Available | Available | Available | |||||

| Input details of savings account | STDSA003 | Available | Not Available | Available | ||||||

| Verify details of savings account | STDSA004 | Available | Not Available | Available | ||||||

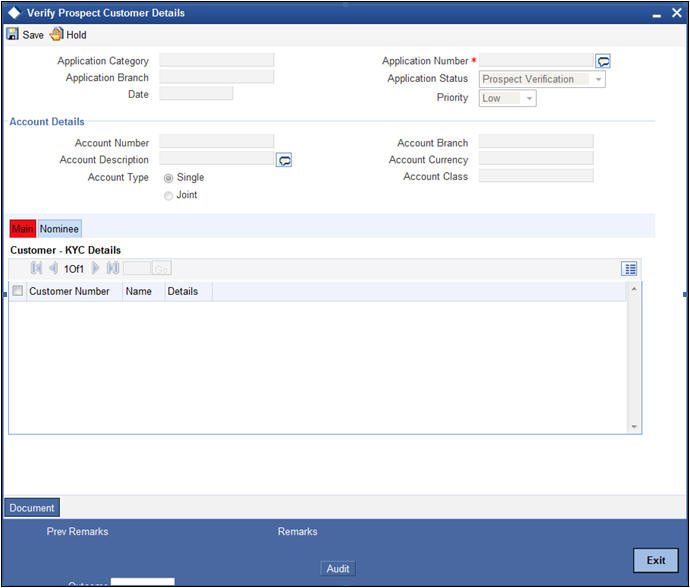

| Modify details of savings account | STDSA005 | Available | Not Available | Available | ||||||

| Verify prospect /customer details | STDKYR01 | Available | Available | Available | ||||||

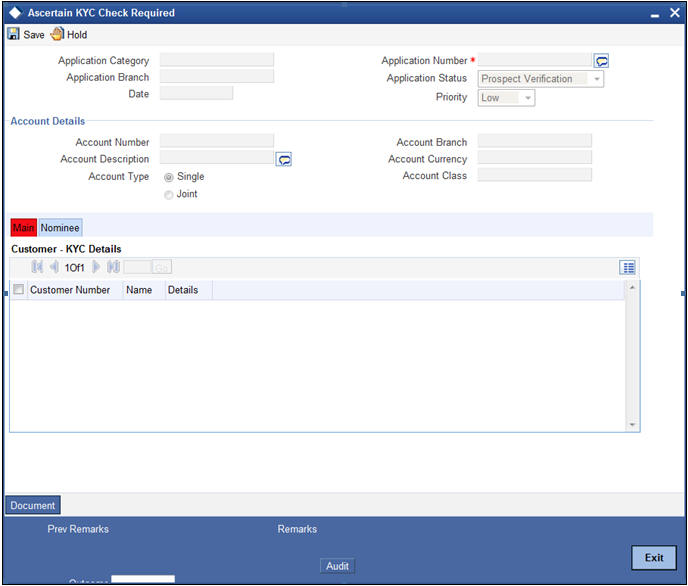

| Ascertain if KYC checks are required | STDKYR02 | Available | Available | Available | ||||||

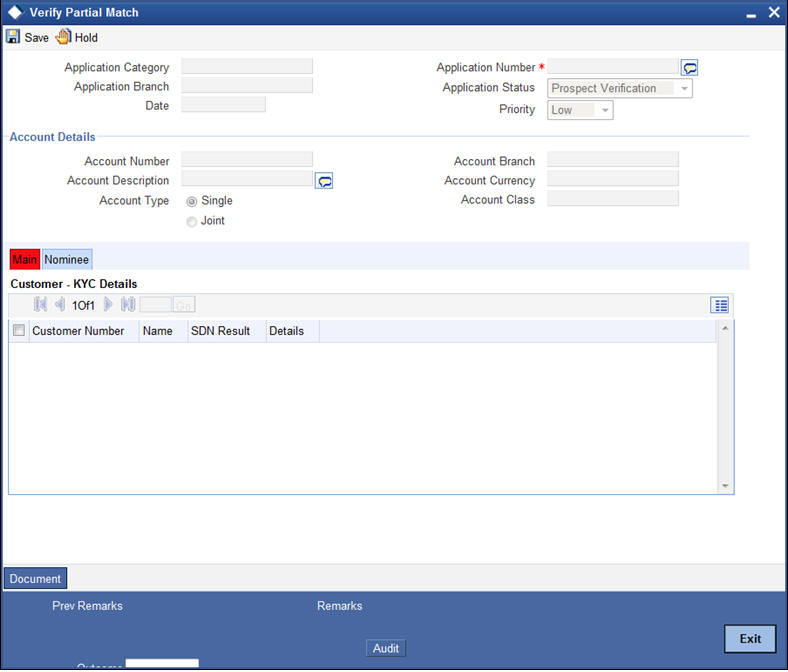

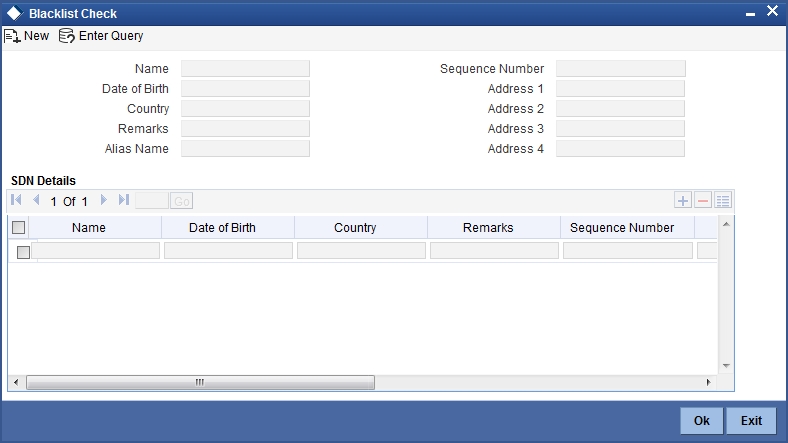

| SDN check | ||||||||||

| Verify SDN Match | STDKYR03 | Available | Not Available | Available | ||||||

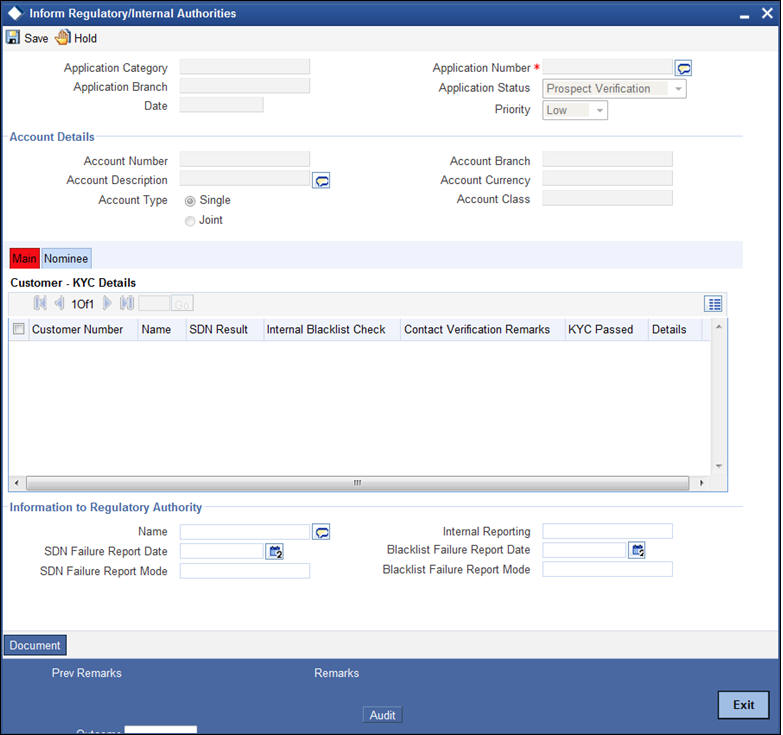

| Inform Regulatory / Internal authorities on KYC checks failure | STDKYR06 | Available | Not Available | Available | ||||||

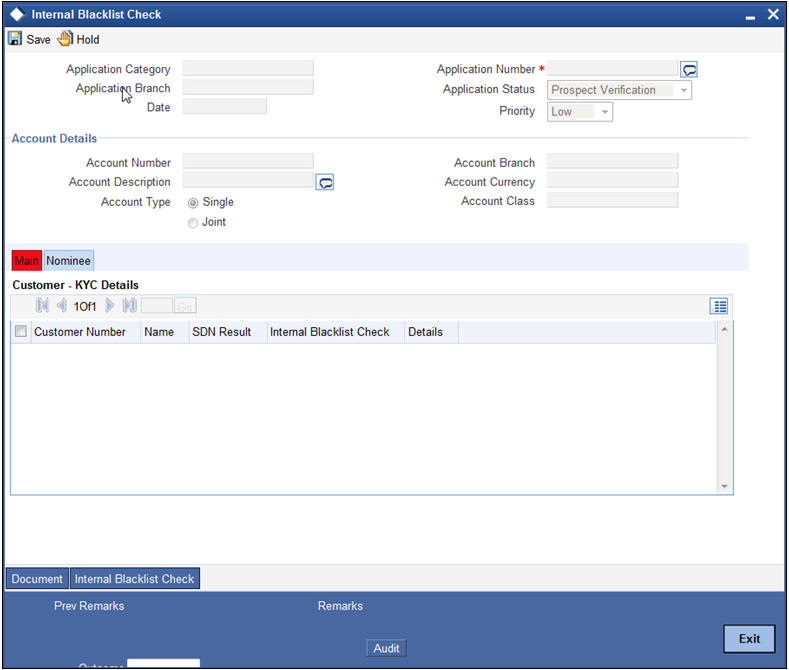

| Internal blacklist check | STDKYR04 | Available | Not Available | Available | ||||||

| Verify customer / prospect contact details | STDKYR05 | Available | Not Available | Available | ||||||

| Other KYC Checks | STDKYR07 | Available | Not Available | Available | ||||||

| KYC Decision | STDKYR08 | Available | Not Available | Available | ||||||

| Sub process – Know your customer checks | ||||||||||

| Block customer in FLEXCUBE | ||||||||||

| Notify prospect / customer on negative status of KYC checks | STDSA018 | Not Available | Not Available | Available | ||||||

| Create / Modify customer details in FLEXCUBE | STDSA020/STDSA021 | Available | Available | Available | ||||||

| Create account in FLEXCUBE | STDSA015 | Available | Not Available | Available | ||||||

| Store document reference in FLEXCUBE | STDSA010 | Available | Not Available | Available | ||||||

| Check available balance | STDSA006 | Available | Not Available | Available | ||||||

| Generate cheque book in FLEXCUBE | STDSA008 | Not Available | ||||||||

| Retrieve preprinted cheque book and capture cheque book details | STDSA007 | Not Available | ||||||||

| Generate welcome / thanks letter in FLEXCUBE | ||||||||||

| Deliver account kit to customer | STDSA009 | Not Available | ||||||||

| Store documents | STDSA010 | Available | Not Available | Available |

Refer the Procedures User Manual for details about task list.

2.7 Seek Approval for Missing Documents / Details

In this stage, the bank will decide whether to approve processing the account opening request as an exception, if the account opening with incomplete details / documents as an exception is approved. The bank proceeds with processing the request and simultaneously arranges to follow up with the customer for submission of the pending details / documents. In case the overrides cannot be approved, the bank obtains the incomplete details / documents from the customer before proceeding further. The decision / remarks of the approver are captured.

Users belonging to the user role RCSMROLE (Retail Customer Service Manager) can perform these activities.

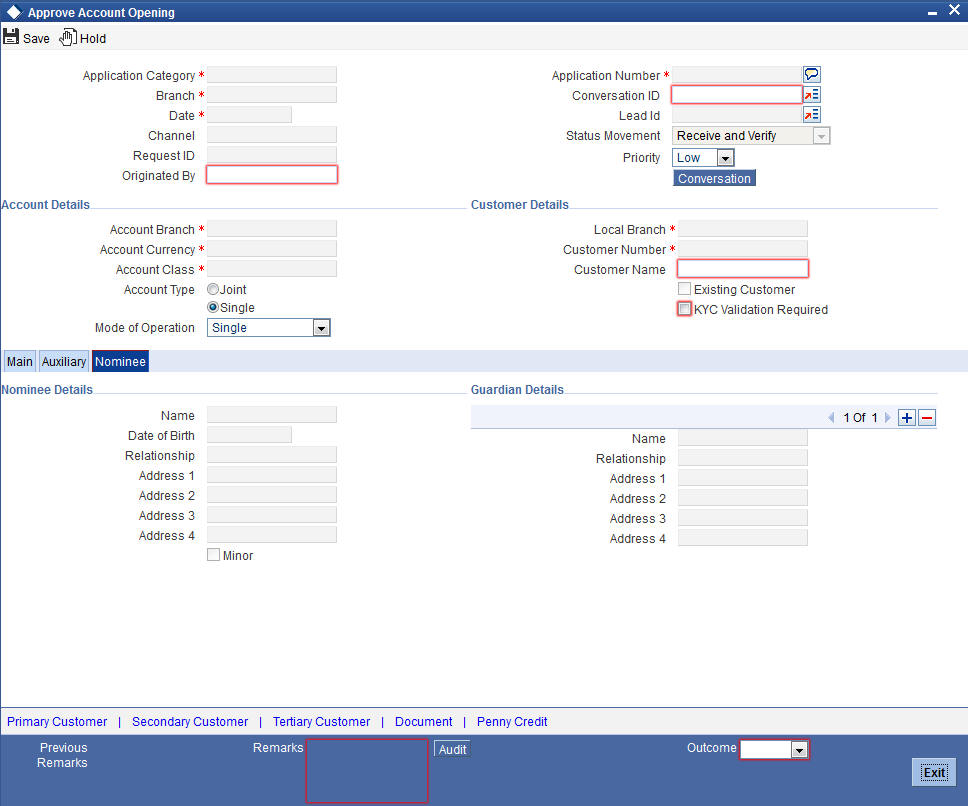

Go to the pending list in the system. The system displays all the pending activities. Click ‘Acquire’ button adjoining the ‘Approve Account Opening’ task to acquire it. The system displays the information message as "..xxx Acquire Successful"

If you have requisite rights, double click on the task in your ‘Assigned’ task list. You can invoke any of the following screens, based on the origination of initiation.

This section contains the following topics:

- Section 2.7.1, "Origination Initiated by Oracle FLEXCUBE Branch"

- Section 2.7.2, "Origination Initiated by External Channels"

- Section 2.7.3, "Auxiliary Tab"

- Section 2.7.4, "Nominee Tab"

- Section 2.7.5, "Specifying Penny Credit Details"

- Section 2.7.6, "Conversation Tab"

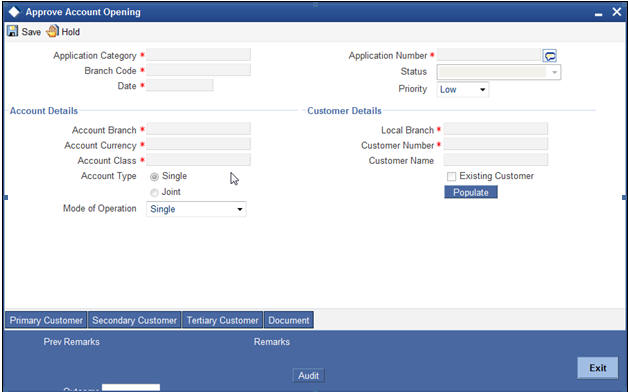

2.7.1 Origination Initiated by Oracle FLEXCUBE Branch

The following details from the first stage are displayed on clicking the ‘Populate’ button:

Header Section

- Application Category

- Branch

- Date

- Channel

- Request ID

- Application Number

- Conversation ID

- Lead ID

- Status

Account Details

- Account Branch

- Account Currency

- Account Class

- Purpose of Account

- Overdraft

Customer Details

- Local Branch

- Customer Number

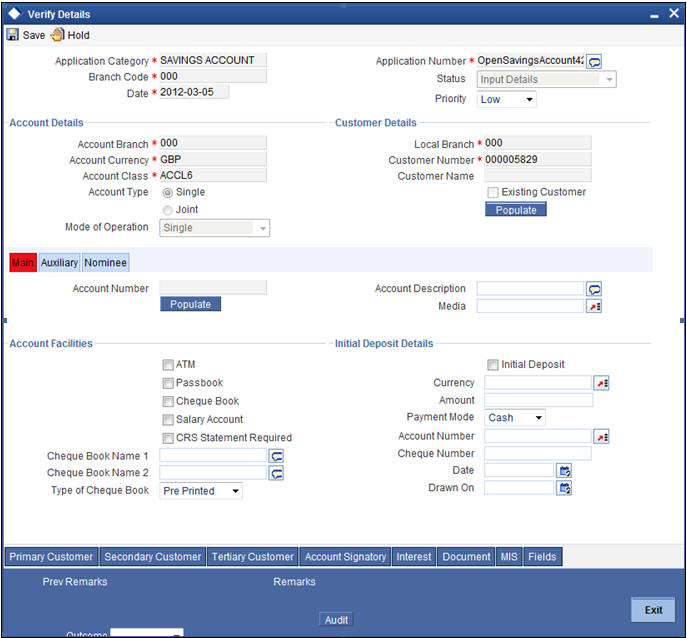

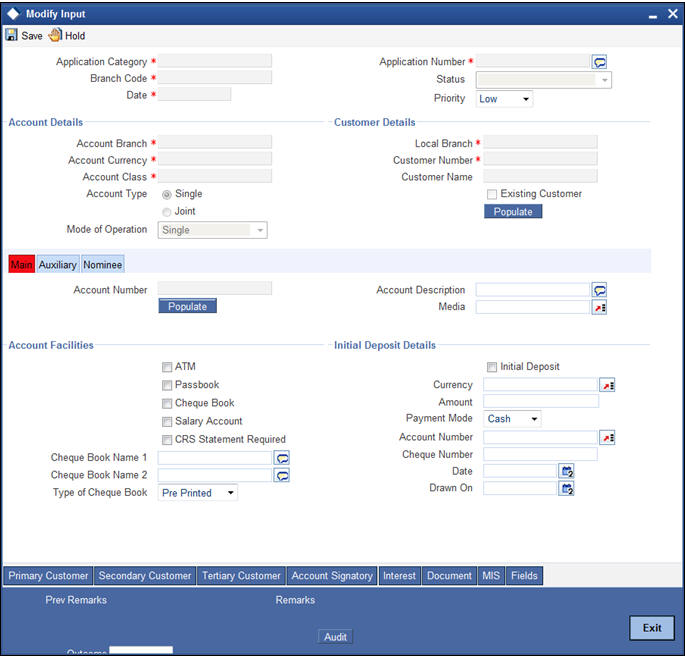

You can specify the following details:

Priority

Select the priority you need to assign to the application from the adjoining drop-down list. This list displays the following values:

- Medium

- Low

- High

Purpose of Account

Specify the purpose for maintaining the account.

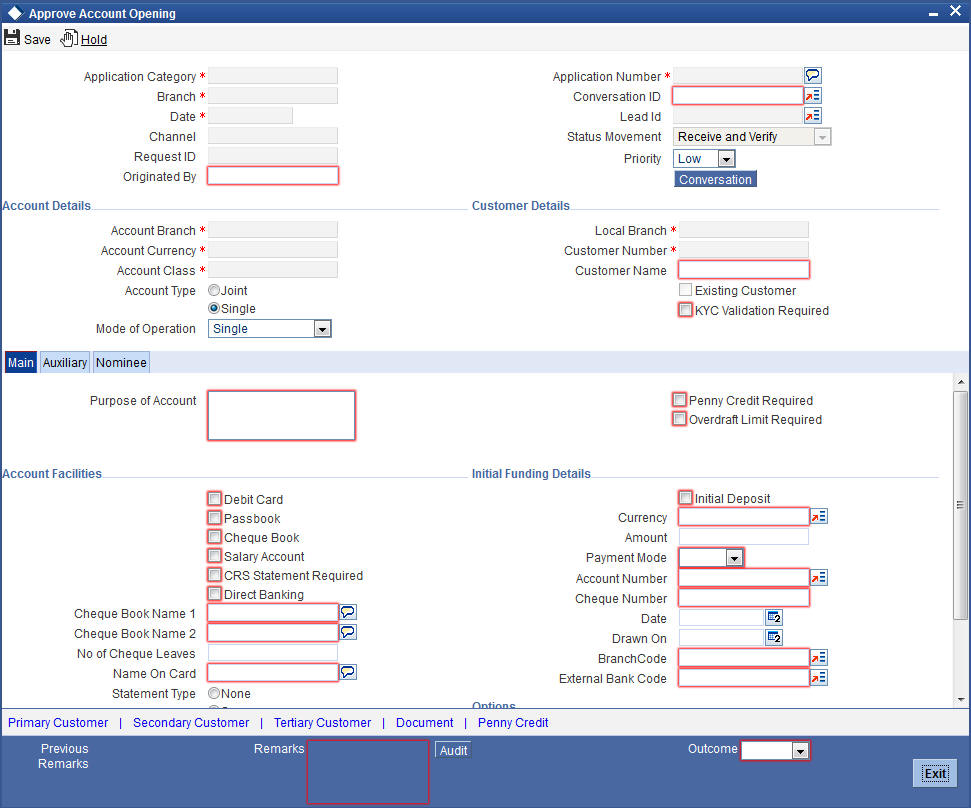

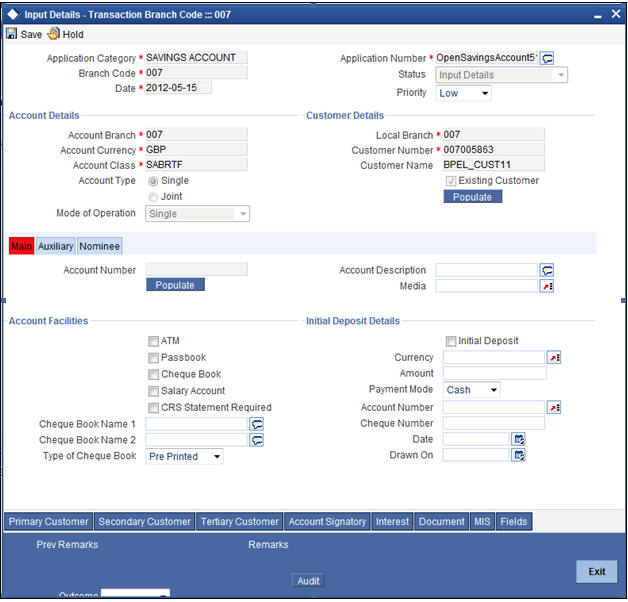

2.7.2 Origination Initiated by External Channels

You can invoke ‘Approve Account Opening’ for savings screen by typing ‘STDSA080’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button

You can maintain the following details:

Account Details

Account Number

Specify the account number.

Account Description

System displays the account description based on the account number specified.

Media

Specify the media i.e the mode of communication to be used. It can either be through SWIFT, mail, fax etc. You can also select the media from the option list provided. The list displays all the media maintained in the system. Select and click the appropriate media.

Purpose Of Account

Specify the purpose for opening an account.

Penny Credit Required

Check this box if you need penny credit validation. Based on the penny credit validation check box and the details obtained for penny credit validation, the system will initiate the penny credit transaction.

Penny Credit is supported only for the Savings Account.

Overdraft Limit Required

Check this box if you require Overdraft Limit.

Customer Details

KYC Validation Required

Check this box if you require KYC validation for the prospect/customer.

The following scenarios are handled based on the value of check box.

- For opening an offline account opening through BPEL flow, the KYC must always be checked and sent by channels.

- During the ‘Ascertain KYC checks required’ stage, Bank user will take the decision on KYC by considering this check box

Account Facilities:

Cheque Book

Check this box if the customer requires the check book facility.

CRS Statement Required

Check this box to indicate that the CRS statement is required.

Debit Card

Check this box if the customer needs a debit card.

Direct Banking

Check this box if the customer needs direct banking facility.

Cheque Book Name1,2

Specify the name customer prefers on the check book.

No of Cheque Leaves

Specify the number of check leaves customer needs.

Name on Card

Specify the name customer prefers on the debit card. If you have checked the ‘Debit Card’ check box, then it is mandatory to provide these details.

Statement Type

Select a valid statement type from the options. The following options are available for selection:

- None

- Summary

- Detailed

Statement Cycle

Select a valid cycle statement from the adjoining drop-down list. This list displays the following options:

- Annual

- Semi Annual

- Quarterly

- Monthly

- Fortnightly

- Weekly

- Daily

On

Specify the Month, Date or Day for the statement generation.

Initial Funding Details

In this section, specify the initial funding details of the customer.

Initial Deposit

Check this box to indicate that initial deposit is required.

Currency

Specify the currency in which the initial amount is deposited. You can also select the appreciate currency from the adjacent option list. The list consists of all the currencies maintained in the system.

Amount

Specify the initial deposit amount.

Payment Mode

Select the mode of initial payment. The options available are:

- GL

- Cash

- Transfer

- Cheque

- Account

Account Number

Specify the account number of the customer from which the initial deposit is made.

Cheque Number

Specify the cheque number if the initial deposit is made through cheque.

Date

Specify the date of the cheque.

Drawn On

Specify the bank on which the cheque is drawn.

Branch

Specify the branch on which the cheque is drawn. The adjoining option list displays all valid branch codes. Select the appropriate one.

External Bank Code

Specify the bank code of the external channel. The adjoining option list displays all valid branch codes. Select the appropriate one.

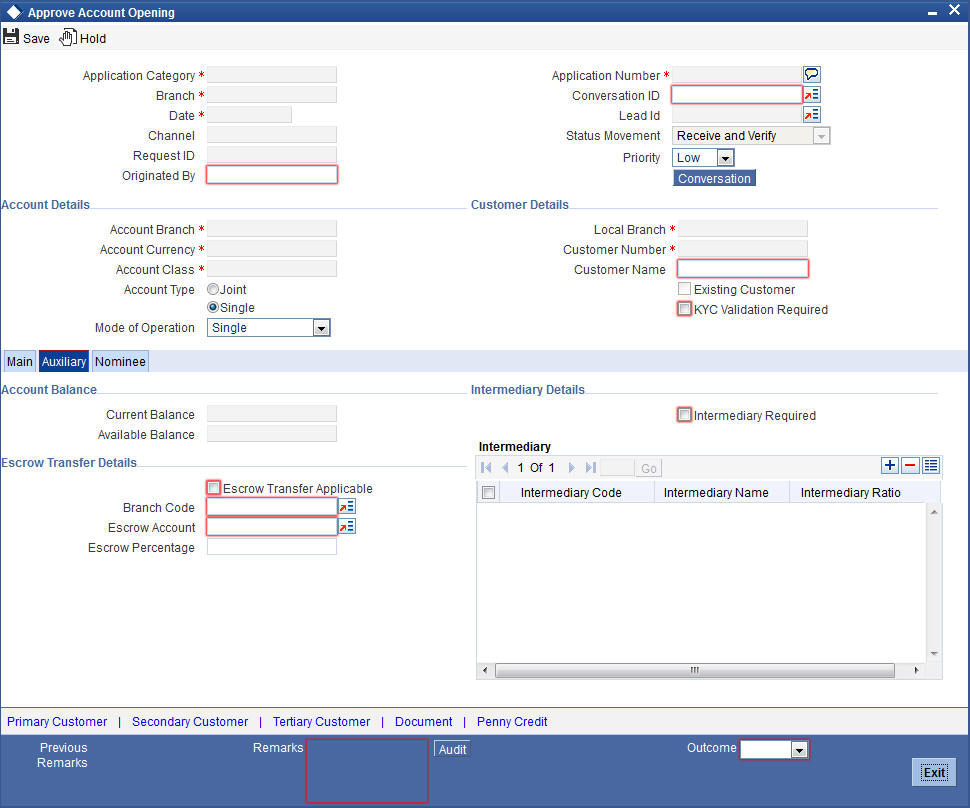

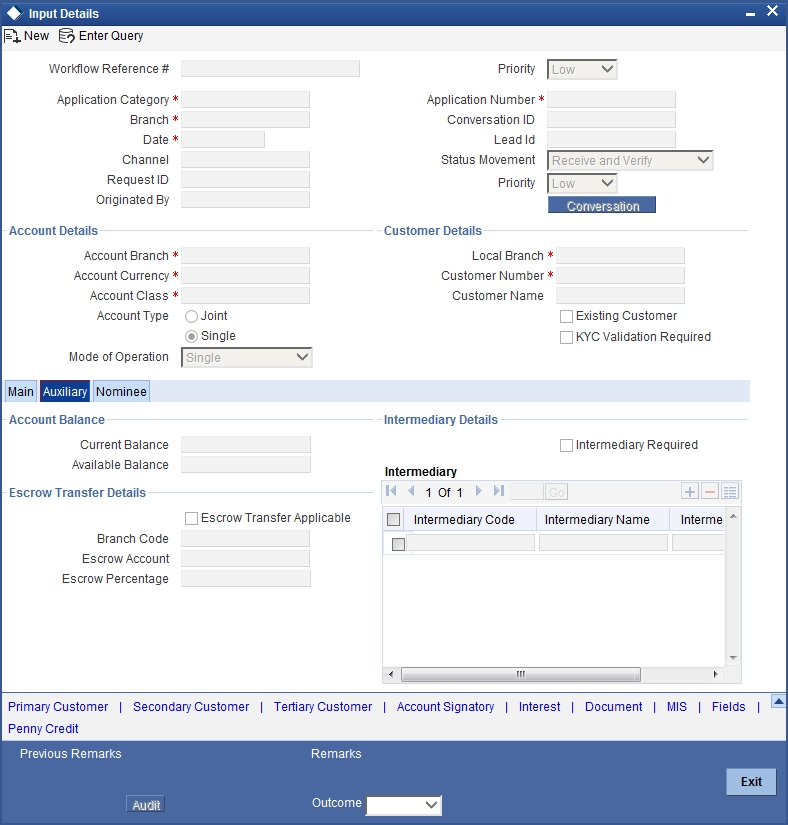

2.7.3 Auxiliary Tab

Click on ‘Auxiliary’ tab to specify the following details:

Account Balance

Current Balance

System displays the current balance of the account.

Available Balance

System displays the available balance of the account.

Intermediary Details

Intermediary Required

Check this box to indicate that the intermediary details have to be provided for the customer.

Escrow Transfer Details

Escrow Transfer Applicable

Check this box to indicate that the escrow transfer is applicable for this account.

Branch Code

Specify the escrow branch code.

Escrow Account

Specify the escrow account number.

Escrow Percentage

Specify the escrow percentage for the account.

Intermediary

Intermediary Code

Specify the intermediary code from the adjoining option list.

Intermediary Name

System displays the intermediary name.

Intermediary Ratio

Specify the intermediary ratio to be divided among intermediaries in case of more than one intermediary.

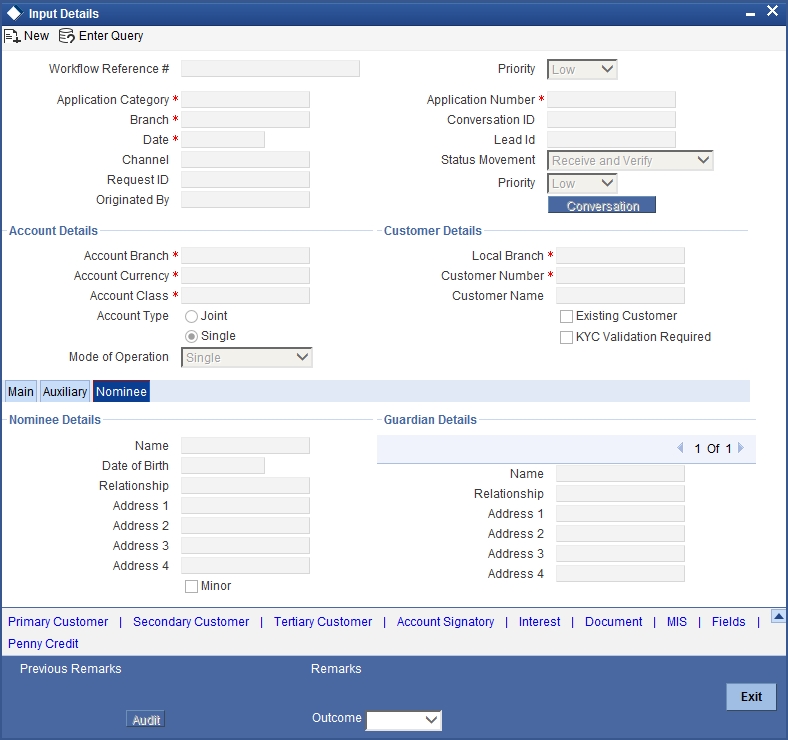

2.7.4 Nominee Tab

Click nominee tab to maintain nominee details:

Nominee Details

Name

Specify the name of nominee.

Date of Birth

Specify the date of birth of nominee.

Relation ship

Specify the relationship of the nominee with the customer

Address 1-4

Specify the address of the nominee.

Minor

Check this box if the nominee is a minor.

Guardian Details

If the nominee is a minor then it is mandatory to maintain the following details

Name

Specify the name of guardian.

Relation ship

Specify the relationship of the nominee with the guardian.

Address 1-4

Specify the address of the guardian.

2.7.5 Specifying Penny Credit Details

Click ‘Penny Credit’ link to maintain penny credit details.

If the ‘Penny Credit Required’ check box is checked, then it is mandatory to provide the details for the mandatory fields in this screen.

Product Category

Specify the Product category in which the PC contract will be created. The adjoining option list displays all valid product categories. Select the appropriate one.

Product Code

Specify the Product code associated with the product category selected. The adjoining option list displays all valid product codes based on the product category selected. Select the appropriate one

Contract Reference

The system displays the reference number of the PC contract.

Debit Account

Specify the account number from which penny credit amount needs to be debited. The adjoining option list displays all valid account numbers. Select the appropriate one.

Beneficiary Details

Bank Code

Specify the Bank code in which prospect maintains the account. The adjoining option list displays all valid bank codes. Select the appropriate one.

Bank Name

The system displays the bank name based on the bank code selected.

City

The system displays the City name based on the bank code selected.

Customer Account

Specify the account number of the customer in the external bank. The adjoining option list displays all valid account number. Select the appropriate one.

Customer Name

Specify the name of the customer as exists in the other bank account number.

Transaction Details

Currency

Specify the currency of the external account. The adjoining option list displays all valid currency codes. Select the appropriate one.

Transaction Amount

Specify the amount which the bank will send to the external bank account for penny credit validation.

Transaction Remarks

Specify the details of workflow reference number and the prospect name, if any.

2.7.6 Conversation Tab

Click ‘Conversation’ button to maintain conversation details.

You can maintain the conversation details here:

Customer Details

Customer ID

The system displays the actual customer ID, if the request is submitted for existing customer. If the customer is prospect, then the system displays the Walk in customer ID.

Customer Name

The system displays the actual customer name, if the application is submitted for existing customer. If the application is for prospect, then the field is blank.

Conversation Details

Conversation ID

The system displays the conversation ID

Priority

Select the priority of the conversation from the adjoining drop-down list. The list displays the following values:

- Low

- Medium

- High

Conversation Category

Select the conversation category from the adjoining drop-down list. The list displays the following values:

- Call Report

- Courtesy Meeting

- Cust Interaction

- Service Request

- Complaints

- Lead

- N/A

- IVR

Conversation Date

Specify the date of conversation from the adjoining calendar icon.

Conversation Status

Select the status of conversation from the adjoining drop-down list. The list displays the following values:

- Open

- WIP

- Close

- Pending with Customer

- Re-open

Venue

Select the venue of conversation from the adjoining drop-down list. The list displays the following values:

- Branch

- Face to Face

- Client Office

- Client Residence

- Public Place

- N/A

Conversation Time

Specify the conversation time.

Target Closure Date

Specify the date of target closure from the adjoining calendar icon.

Conversation Mode

Select the mode of conversation from the adjoining drop-down list. The list displays the following values:

- N/A

- Meeting

- Telephone

- Other

- Face to Face

Last Changed On

Department Details

Department

Specify the department of the bank to which the conversation is sent. The adjoining option list displays all valid departments. Select the appropriate one.

Other Department

Specify other departments, if different from the once listed in ‘Department’ field.

Senior Management Involved

Select the senior management involved in the conversation, if any, from the adjoining drop-down list. The list displays the following values:

- N/A

- COO

- Region Head

- Senior RM

- CEO

User/Role

Select ‘User’ or ‘Role’ to which the conversation is assigned.

Assigned To

Specify the User/Role to which the conversation is assigned. The adjoining option list displays all valid User and Role types maintained in the system. Select the appropriate one.

Other Offices Involved

Specify the other offices, if any are involved.

Channel Details

The system defaults the following channel details:

- Direct Access Channel

- External System User ID

- Channel User ID

Message Details

Original Request

Specify the details of the original request.

Subject

Specify the subject of the message.

Detail

Specify the details of the message.

Documents Presented

Specify the documents presented.

Reply to the Customer

Select ‘yes’ or ‘No’ to indicate the system to send a reply to the customer.

Closure Remarks

Specify the closure remarks, if any

Below table depicts the different use cases for interaction:

| Use Cases | Customer/Prospect | Conversation ID field in main screen | Conversation ID in call button | Customer ID | Assigned To | Remarks | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|